Rogers 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 93

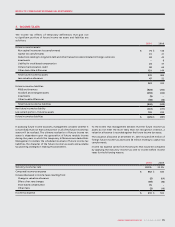

The goodwill has been allocated to the Media reporting segment

and is not tax deductible.

The customer relationships are being amortized over a period of

2 years.

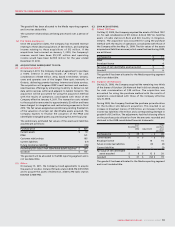

(v) Pro forma disclosures:

Since the acquisition dates, the Company has recorded revenue

relating to these above acquisitions of $30 million, and operating

income relating to these acquisitions of $12 million. If the

acquisitions had occurred on January 1, 2010, the Company’s

revenue would have been $12,207 million and operating

income would have been $2,905 million for the year ended

December31,2010.

(B) ACQUISITIONS SUBSEQUENT TO 2010:

(i) Atria Networks LP:

On January 4, 2011, the Company closed an agreement to purchase

a 100% interest in Atria Networks LP (“Atria”) for cash

consideration of $425 million. Atria, based in Kitchener, Ontario,

owns and operates one of the largest fibre-optic networks in

Ontario, delivering premier business Internet and data services.

The acquisition will augment RBS’s small business and medium-

sized business offerings by enhancing its ability to deliver on-net

data centric services within and adjacent to Cable’s footprint. The

acquisition will be accounted for using the acquisition method

with the results of operations consolidated with those of the

Company effective January 4, 2011. The transaction costs related

to the acquisition amounted to approximately $2 million and have

been charged to integration and restructuring expenses in fiscal

2010. The fair values assigned are preliminary pending finalization

of the valuation of certain net identifiable assets acquired. The

Company expects to finalize the valuation of the PP&E and

identifiable intangible assets acquired during the 2011 fiscal year.

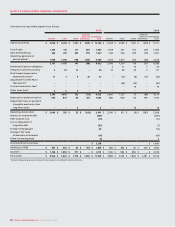

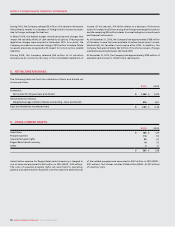

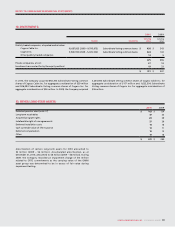

The preliminary estimated fair values of the assets and liabilities

assumed are as follows:

Purchase price $ 425

Current assets $ 10

PP&E 121

Customer relationships 195

Current liabilities (17)

Future income tax liabilities (45)

Preliminary fair value of net identifiable assets acquired $ 264

Goodwill $ 161

The goodwill will be allocated to the RBS reporting segment and is

not tax deductible.

(ii) Other:

On January 31, 2011, the Company closed agreements to acquire

the assets of London, Ontario FM radio station BOB-FM (CHST-FM)

and to acquire the assets of Edmonton, Alberta FM radio station

BOUNCE (CHBN-FM).

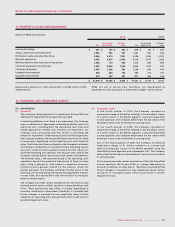

(C) 2009 ACQUISITIONS:

(i) K-Rock 1057 Inc.:

On May 31, 2009, the Company acquired the assets of K-Rock 1057

Inc. for cash consideration of $11 million. K-Rock 1057 Inc. held the

assets of radio stations K-Rock and KIX Country in Kingston,

Ontario. The acquisition was accounted for using the purchase

method with the results of operations consolidated with those of

the Company effective May 31, 2009. The fair values of the assets

acquired and liabilities assumed, which were finalized during 2009,

are as follows:

Purchase price $ 11

PP&E $ 1

Broadcast licence 4

Fair value of net identifiable assets acquired $ 5

Goodwill $ 6

The goodwill has been allocated to the Media reporting segment

and is tax deductible.

(ii) Outdoor Life Network:

On July 31, 2008, the Company acquired the remaining two-thirds

of the shares of Outdoor Life Network that it did not already own,

for cash consideration of $39 million. The acquisition was

accounted for using the purchase method with the results of

operations consolidated with those of the Company effective

July31,2008.

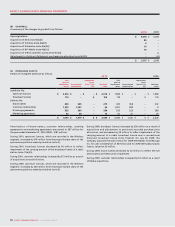

During 2009, the Company finalized the purchase price allocation

for the Outdoor Life Network acquisition. This resulted in an

increase in broadcast licence of $15 million, an increase in future

income tax liabilities of $3 million and a corresponding decrease in

goodwill of $12 million. The adjustments had the following effects

on the purchase price allocation from the amounts recorded and

disclosed in the 2008 consolidated financial statements:

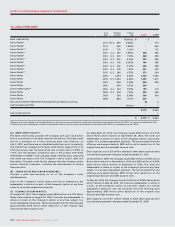

As at

December 31,

2008

Adjustments

Final

purchase

price

allocation

Purchase price $ 39 $ – $ 39

Current assets $ 11 $ – $ 11

Broadcast licence – 15 15

Future income tax liabilities – (3) (3)

Current liabilities (3) – (3)

Fair value of net identifiable

assets acquired $ 8 $ 12 $ 20

Goodwill $ 31 $ (12) $ 19

The goodwill has been allocated to the Media reporting segment

and is not tax deductible.