Rogers 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 41

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

MEDIA’S STRATEGY

Media seeks to maximize revenues, operating profit and return on

invested capital across its portfolio of businesses. Media’s strategies to

achieve this objective include:

• Continuingtoleverageitsstrongmediabrandsandcontentacross

its multiple media platforms to offer advertising customers more

comprehensive audience solutions and reach;

• Driverevenueshareincreasesbycontinuallyimprovingbroadcast

ratings through strategically developing and securing the rights to

unique and compelling content;

• CollaborativelyworkingwithWirelessandCabletoprovideunique

video, online and wireless content experiences to customers over

advanced network distribution platforms and in association with the

“Rogers” brand;

• Focusingonspecializedcontentandaudiencedevelopmentthrough

its broadcast and sports properties, as well its growing portfolio of

specialty channel and online assets;

• Continuing to invest in technology and content to leverage the

trend of audience migration to the web, wireless and other digital

platforms; and

• EnhancingtheSportsEntertainmentfanexperiencebycontinuing

to invest in enhancing the Blue Jays and in upgrades to the

Rogers Centre.

RECENT MEDIA INDUSTRY TRENDS

Migration to Digital Media

The media landscape continues to evolve driven by the following major

forces impacting audience and advertiser behaviour:

• Digitizationofcontent;

• Increasedavailabilityofhigh-speedbroadbandnetworks;

• Increasinglyfragmentedandtime-shiftedaudiencetimeandattention;

• Explosionofuser-generated,freeandpiratedcontent;and

• Marketerssearchingforhigher-ROImediavehicles.

The impact of the foregoing is that audiences are shifting a portion

of their time and attention from traditional broadcast and print to

online and other digital media. As a result, advertisers are following

this trend by shifting a portion of their spending from traditional to

digital media formats.

Consolidation and Ownership of Industry Competitors

Ownership of Canadian radio and TV stations has consolidated through

several large acquisitions in the sector by other media and

telecommunications companies. This has resulted in the Canadian

media sector being composed of fewer owners but larger competitors

with more financial resources to compete in the media marketplace.

MEDIA OPERATING AND FINANCIAL RESULTS

Media’s revenues primarily consist of:

• Advertisingrevenues;

• Circulationrevenues;

• Subscriptionrevenues;

• Retailproductsales;and

• Salesoftickets,receiptsofMLBrevenuesharingandconcessionsales

associated with Rogers Sports Entertainment.

Media’s operating expenses consist of:

• Cost of sales, which is primarily comprised of the cost of retail

products sold by The Shopping Channel;

• Salesandmarketingexpenses;and

• Operating, general and administrative expenses, which include

programming costs, production expenses, circulation expenses, Blue

Jays player salaries and other back-office support functions.

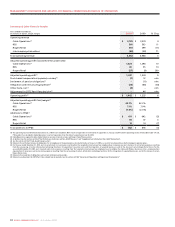

Summarized Media Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2010(1) 2009 %Chg

Operating revenue $ 1,501 $ 1,407 7

Operating expenses before the undernoted 1,354 1,288 5

Adjusted operating profit(2) 147 119 24

Stock-based compensation (expense) recovery(3) (9) 8 n/m

Settlement of pension obligations(4) – (15) n/m

Integration and restructuring expenses(5) (12) (35) (66)

Other items, net(6) (4) –n/m

Contract termination fee(7) –(19) n/m

Adjustment for CRTC Part II fees decision(8) – 15 n/m

Operating profit(2) $ 122 $ 73 67

Adjusted operating profit margin(2) 9.8% 8.5%

Additions to PP&E(2) $ 46 $ 62 (26)

(1) The operating results of BV! Media Inc. (“BV! Media”) are included in Media’s results of operations from the date of acquisition on October 1, 2010.

(2) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”.

(3) See the section entitled “Stock-based Compensation”.

(4) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(5) For the year ended December 31, 2010, cost incurred related to i) severances resulting from the targeted restructuring of our employee base; and ii) the acquisition transaction costs incurred and the

integration of acquired businesses. For the year ended December 31, 2009, costs incurred relate to severances resulting from the targeted restructuring of our employee base.

(6) Relates to the resolution of obligations and accruals relating to prior periods.

(7) Relates to the termination and release of certain Blue Jays players from the remaining term of their contracts.

(8) Relates to an adjustment for CRTC Part II fees related to prior periods.