Rogers 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

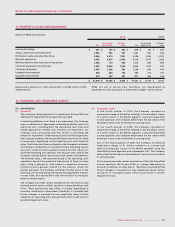

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

104 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

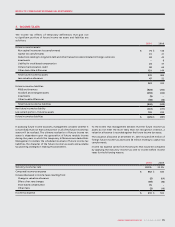

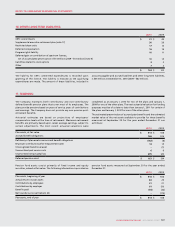

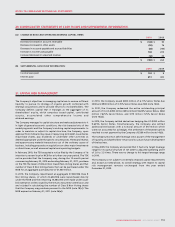

2010

U.S. $

notional

Exchange

rate

Cdn. $

notional

Unadjusted

mark-to-

market

value

on a

risk free

basis

Estimated

fair value,

being

carrying

amount on

a credit risk

adjusted

basis

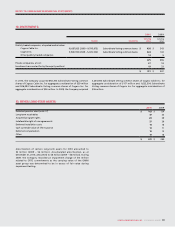

Derivatives accounted for as cash flow hedges:

As assets $ 575 1.0250 $ 589 $ 7 $ 7

As liabilities 4,125 1.2021 4,959 (918) (901)

Net mark-to-market liability (911) (894)

Derivatives not accounted for as hedges:

As liabilities 350 1.0258 359 (6) (6)

Net mark-to-market liability (6) (6)

Net mark-to-market liability $ (917) $ (900)

Less net current liability portion (66)

Net long-term liability portion $ (834)

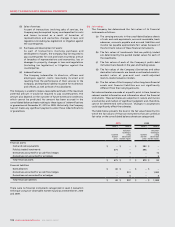

In 2010, nil (2009 – $1 million increase) related to hedge ineffectiveness

was recognized in net income.

The long-term portion above comprises a derivative instruments

liability of $840 million and a derivative instruments asset of $6 million

as at December 31, 2010.

At December 31, 2010, all of the Company’s long-term debt was at fixed

interest rates.

US$350 million of the Company’s U.S. dollar-denominated long-term

debt instruments are not hedged for accounting purposes and, therefore,

a one cent change in the Canadian dollar relative to the U.S. dollar

would have resulted in a $4 million change in the carrying value of long-

term debt at December 31, 2010. In addition, this would have resulted in

a $3 million change in net income, net of income taxes of $1 million.

A portion of the Company’s accounts receivable and accounts payable

and accrued liabilities is denominated in U.S. dollars; however, due to

their short-term nature, there is no significant market risk arising from

fluctuations in foreign exchange rates.

All of the Company’s Derivatives are unsecured obligations of RCI. In

addition, RCP has provided unsecured guarantees for all of the

Company’s Derivatives (notes 14(e) and 15(b)).

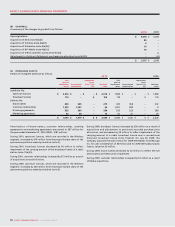

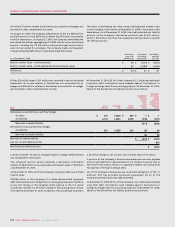

At December 31, 2009, 93.7% of the Company’s U.S. dollar-denominated

long-term debt instruments were hedged against fluctuations in

foreign exchange rates for accounting purposes. At December 31, 2009,

details of the Derivatives net liability position are as follows:

All of the $17 million related to Derivatives accounted for as hedges was

recorded in other comprehensive income.

On August 27, 2010, the Company redeemed all of the U.S.$490 million

principal amount of its 9.625% Senior Notes due 2011 and, concurrently

with this redemption, on August 27, 2010, the Company terminated the

associated Derivatives aggregating U.S.$500 million notional principal

amount, including the U.S.$10 million notional principal amount which

were not accounted for as hedges. The Company made a net payment

of approximately $269 million to terminate these Derivatives.

The effect of estimating fair value using credit-adjusted interest rates

on the Company’s Derivatives at December 31, 2009 is illustrated in the

table below. As at December 31, 2009, the credit-adjusted net liability

position of the Company’s Derivative portfolio was $1,002 million,

which is $25 million less than the unadjusted risk-free mark-to-market

net liability position.

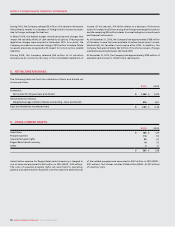

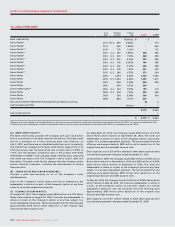

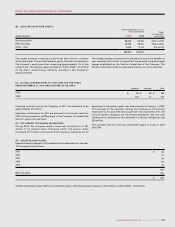

As at December 31, 2009

Derivatives

in an asset

position (A)

Derivatives

in a liability

position (B)

Net liability

position

(A) + (B)

Mark-to-market value – risk-free analysis $ 94 $ (1,121) $ (1,027)

Mark-to-market value – credit-adjusted estimate (carrying value) 82 (1,084) (1,002)

Difference $ (12) $ 37 $ 25

Of the $25 million impact, ($1) million was recorded in the consolidated

statements of income related to Derivatives not accounted for as

hedges and $26 million related to Derivatives accounted for as hedges

was recorded in other comprehensive income.

At December 31, 2010, 93.1% of the Company’s U.S. dollar-denominated

long-term debt instruments were hedged against fluctuations in

foreign exchange rates for accounting purposes. At December 31, 2010,

details of the Derivatives net liability position are as follows: