Rogers 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

96 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

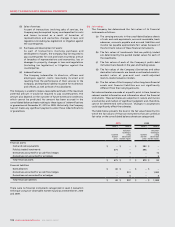

During 2010, the Company released $5 million of its valuation allowance

that primarily relates to a decrease of foreign future income tax assets

due to foreign exchange fluctuations.

In March 2010, the federal budget introduced proposed changes that

impact the tax deductibility of cash-settled stock options. The proposed

legislative changes were enacted in December 2010. As a result, the

Company recorded an income tax charge of $35 million to reduce future

tax assets previously recognized with respect to its stock option-related

liabilities.

During 2009, the Company released $64 million of its valuation

allowance as an income tax recovery in the consolidated statements of

income. Of this amount, $14 million relates to a decrease of future tax

assets in foreign jurisdictions arising from foreign exchange fluctuations

and the remaining $50 million relates to unrealized gains on investments

and financial instruments.

As at December 31, 2010, the Company had approximately $188 million

of Canadian income tax losses available to reduce future years’ income.

Substantially all Canadian losses expire after 2025. In addition, the

Company had approximately $62 million of income tax losses in foreign

subsidiaries expiring between 2023 and 2029.

At December 31, 2010, the Company had approximately $238 million of

available capital losses to offset future capital gains.

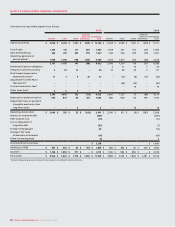

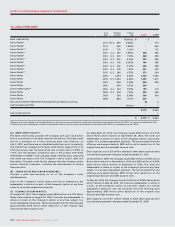

The following table sets forth the calculation of basic and diluted net

income per share:

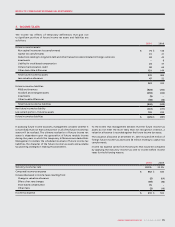

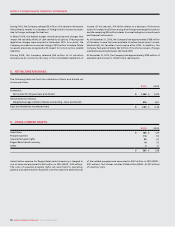

8. NET INCOME PER SHARE:

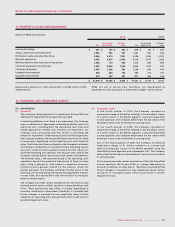

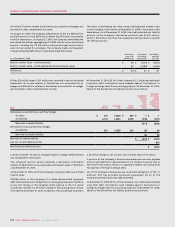

9. OTHER CURRENT ASSETS:

2010 2009

Numerator:

Net income for the year, basic and diluted $ 1,528 $ 1,478

Denominator (in millions):

Weighted average number of shares outstanding – basic and diluted 576 621

Basic and diluted net income per share $ 2.65 $ 2.38

2010 2009

Inventories $ 185 $ 129

Prepaid expenses 114 110

Acquired program rights 49 61

Rogers Retail rental inventory 14 27

Other 311

$ 365 $ 338

Amortization expense for Rogers Retail rental inventory is charged to

cost of sales and amounted to $54 million in 2010 (2009 – $43 million).

The costs of acquired program rights are amortized to operating,

general and administrative expenses over the expected performances

of the related programs and amounted to $167 million in 2010 (2009 –

$131 million). Cost of sales includes $1,466 million (2009 – $1,337 million)

of inventory costs.