Rogers 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

46 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

3. CONSOLIDATED LIQUIDITY AND FINANCING

LIQUIDITY AND CAPITAL RESOURCES

Operations

For 2010, cash generated from operations before changes in non-cash

operating items, which is calculated by removing the effect of all non-

cash items from net income, increased to $3,800 million from $3,526

million in 2009. The $274 million increase includes the impact of a $265

million increase in adjusted operating profit.

Taking into account the changes in non-cash working capital items for

2010, cash generated from operations was $3,620 million, a decrease of

$170 million, compared to $3,790 million in 2009. The cash generated

from operations of $3,620 million, together with the following items,

resulted in total net funds of approximately $5,323 million in 2010:

• thereceiptofanaggregate$1,700milliongrossproceedsfromtwo

new public debt issues: the August 2010 issuance of $800 million

6.11%SeniorNotesdue2040andtheSeptember2010issuanceof

$900million4.70%SeniorNotesdue2020;

• thereceiptof$3millionfromtheissuanceofClassBNon-Voting

shares under the exercise of employee stock options.

Net funds used during 2010 totalled approximately $5,746 million, the

details of which include the following:

• additionstoPP&Eof$1,713million,netof$126millionofrelated

changes in non-cash working capital;

• thepaymentofanaggregate$1,499millionfortheAugust2010

redemption of three public debt issues maturing in 2011, comprising

$1,151 million aggregate principal amount, $79 million aggregate

redemption premiums and $269 million net settlement paid on

termination of the associated Derivatives;

• thepurchaseforcancellationof37,080,906ClassBNon-Votingshares

for an aggregate purchase price of $1,312 million;

• thepaymentofquarterlydividendsaggregating$734milliononour

Class A Voting and Class B Non-Voting shares;

• thepurchaseof892,250subordinatevotingsharesofCogecoCable

Inc. and 946,090 subordinate voting shares of Cogeco Inc. for an

aggregate purchase price of $75 million;

• acquisitionsandothernetinvestmentsaggregating$242million,

including $131 million to acquire Blink Communications Inc.,

$47 million for the acquisition

of spectrum licences through

Inukshuk, $26 million to acquire

Cityfone Telecommunications

Inc., $20 million to acquire

Kincardine Cable T.V. Ltd. and

$24 million to acquire BV!

Media Inc.;

• additions to program rights

aggregating $170 million; and

• therepaymentof$1millionof

capital leases.

Taking into account the opening cash and cash equivalents balance of

$383 million at the beginning of the year and the cash sources and uses

described above, the cash deficiency at December 31, 2010, represented

by bank advances, was $40 million.

Financing

Our long-term debt instruments are described in Note 14 and Note 15

to the 2010 Audited Consolidated Financial Statements. During 2010,

the following financing activities took place.

Debt Issuances

On August 25, 2010, RCI issued in Canada $800 million aggregate

principalamountof6.11%SeniorNotesdue2040(the“2040Notes”).

The2040Noteswereissuedatadiscountof99.904%foraneffective

yieldof6.117%perannumifheldtomaturity.RCIreceivednetproceeds

of $794 million from the issuance of the 2040 Notes after deducting the

original issue discount, agents’ fees and other related expenses. The

net proceeds from the 2040 Notes were used together with cash on

hand and advances under our bank credit facility to fund the August

2010 redemptions of three public debt issues maturing in 2011 together

with the termination of the associated Derivatives, each as described

below under the section entitled “Debt Redemptions and Termination

of Derivatives”.

On September 29, 2010, RCI issued in Canada $900 million aggregate

principalamountof4.70%SeniorNotesdue2020(the“2020Notes”).

The2020Noteswereissuedatadiscountof99.945%foraneffective

yield of 4.707% per annum if held to maturity. RCI received net

proceeds of $895 million from the issuance of the 2020 Notes after

deducting the original issue discount, agents’ fees and other related

expenses. The net proceeds from the 2020 Notes were used to repay

outstanding advances under our bank credit facility, which had been

borrowed to partially fund the redemptions and termination of the

associated Derivatives, and for general corporate purposes.

RCI received an aggregate net proceeds of $1,689 million from the

issuance of the 2040 Notes and the 2020 Notes after deducting the

original issue discount, agents’ fees and other related expenses. We

recorded debt issuance costs of $10 million in 2010 due to the

transaction costs incurred in connection with the issuance of the 2040

Notes and the 2020 Notes. Each of the 2040 Notes and the 2020 Notes

are guaranteed by RCP and rank pari passu with all of RCI’s other senior

unsecured notes and debentures and bank credit facility. See the

section entitled “July 1, 2010 Corporate Reorganization”.

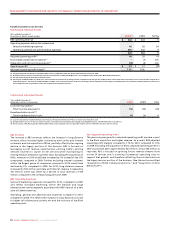

20102009

2008

2009

200

8

201

0

$3,526$3,500 $3,800

CONSOLIDATED CASH FLOW

FROM OPERATIONS

(In millions of dollars)

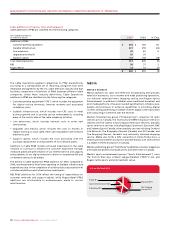

2010 USES OF CASH

(In millions of dollars)

2010

Additions to program rights: $170

Acquisitions and other net investments: $318

Dividends: $734

Repurchase of shares: $1,312

Redemption of long-term debt: $1,499

$5,746

Cash PP&E expenditures: $1,713