Rogers 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 39

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

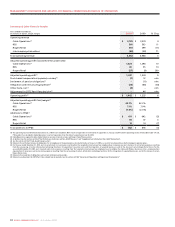

ROGERS RETAIL

Summarized Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2010 2009 %Chg

Operating revenue

Wireless and Cable sales $ 212 $ 192 10

Video rental and sales 143 207 (31)

Total Rogers Retail operating revenue 355 399 (11)

Operating expenses before the undernoted 382 408 (6)

Adjusted operating loss(1) (27) (9) 200

Stock-based compensation recovery(2) – 1 n/m

Settlement of pension obligations(3) –(1) n/m

Integration and restructuring expenses(4) (7) (12) (42)

Other items, net(5) 2–n/m

Operating loss(1) $ (32) $ (21) 52

Adjusted operating loss margin(1) (7.6%) (2.3%)

(1) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(2) See the section entitled “Stock-based Compensation”.

(3) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(4) For the year ended December 31, 2010, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base; and ii) the closure of certain Rogers Retail stores. For the year ended

December 31, 2009, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses into a communications organization; and

ii) the closure of certain Rogers Retail stores.

(5) Relates to the resolution of accruals relating to prior periods.

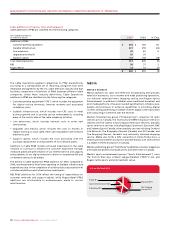

Acquisition of Atria Networks LP

Subsequent to the year-end 2010, on January 4, 2011, Cable acquired

Atria Networks LP (“Atria”) for cash consideration of $425 million.

Atria, based in Kitchener, Ontario, owns and operates one of the largest

fibre-optic networks in Ontario, delivering on-net data networking

services to business customers in approximately 3,700 buildings in and

adjacent to Cable’s service area.

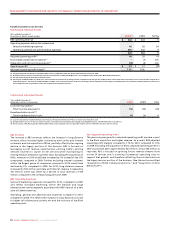

Cable Additions to PP&E

Rogers Retail Revenue

The decrease in Rogers Retail revenue for 2010, compared to 2009, was

the result of a continued decline in video rental and sales activity. This

was partially offset by the continued growth in sales and services

associated with Wireless and Cable customers.

Early in 2010, Rogers began an initiative to more deeply integrate its

wireless, cable and video rental distribution channels to better respond

to changing customer needs and preferences. As a result of this

integration, certain facilities and stores associated principally with the

video rental portion of Rogers Retail have been and will continue to

be closed.

Rogers Retail Adjusted Operating Loss

The adjusted operating loss at Rogers Retail increased for 2010,

compared to 2009, reflecting the changes and trends noted above.

CABLE ACQUISITIONS

Acquisition of Blink Communications Inc.

OnJanuary29,2010,Cableacquired100%oftheoutstandingcommon

shares of Blink, a wholly-owned subsidiary of Oakville Hydro

Corporation, for cash consideration of $131 million. Blink is a facilities-

based, data network service provider that delivers next generation and

leading-edge services, to small and medium-sized businesses, including

municipalities, universities, schools and hospitals, in the Oakville,

Milton, and Mississauga, Ontario areas. The acquisition was accounted

for using the acquisition method with the results of operations

consolidated with those of ours effective January 29, 2010.

Acquisition of Kincardine Cable T.V. Ltd.

On July 30, 2010, Cable acquired the assets of Kincardine for cash

consideration of $20 million. Kincardine provides cable television and

Internet services in Kincardine, Ontario and the surrounding area. The

acquisition was accounted for using the acquisition method with the

results of operations consolidated with those of ours effective

July30,2010.

Business Solutions 6% Retail 2%

Cable Operations 92%

CABLE ADDITIONS TO PP&E