Rogers 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

44 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

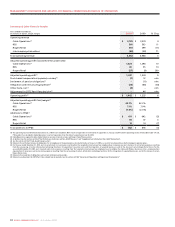

Years ended December 31,

(In millions of dollars) 2010 2009

Statutory income tax rate 30.5% 32.3%

Income before income taxes $ 2,138 $ 1,980

Computed income tax expense 652 640

Increase (decrease) in income taxes resulting from:

Change in valuation allowance (5) (64)

Effect of tax rate changes (69) (58)

Stock-based compensation 35 –

Other items (3) (16)

Income tax expense $ 610 $ 502

Effective income tax rate 28.5% 25.4%

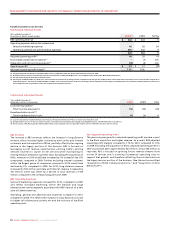

Other Expense (Income)

Other expense of $1 million in 2010 was primarily associated with

investment income and expenses from certain of our investments,

compared to income of $6 million in 2009.

Change in Fair Value of Derivative Instruments

In 2010, the change in fair value of the derivative instruments was the

result of the $16 million (2009 – $65 million) non-cash change in the fair

value of the cross-currency interest rate exchange agreements

(“Derivatives”) hedging our US$350 million Senior Notes due 2038 that

have not been designated as hedges for accounting purposes. This

change in fair value of the Derivatives was primarily caused by the

Canadian dollar’s strengthening by 5.6 cents in 2010 (2009 – 17.4 cents)

versus the U.S. dollar. We have recorded the fair value of our Derivatives

at an estimated credit-adjusted mark-to-market valuation. For the

impact, refer to the section entitled “Mark-to-Market Value

of Derivatives”.

Loss on Repayment of Long-Term Debt

During 2010, we recorded a loss of repayment of long-term debt of $87

million, comprised of aggregate redemption premiums of $79 million

related to the redemption of three public debt issues and a net loss on

the termination of the related Derivatives of $16 million, partially offset

by a gain of $8 million relating to the non-cash write-down of the fair

value increment of long-term debt (See the section entitled “Debt

Redemptions and Termination of Derivatives”).

Foreign Exchange Gain

During 2010, the Canadian dollar strengthened by 5.6 cents versus the

U.S. dollar resulting in a foreign exchange gain of $20 million, primarily

related to our US$350 million of Senior Notes due 2038 for which the

associated Derivatives have not been designated as hedges for

accounting purposes. During 2009, the Canadian dollar strengthened

by 17.4 cents versus the U.S. dollar, resulting in a foreign exchange gain

of $136 million, primarily related to US$750 million of our U.S. dollar-

denominated long-term debt that was not hedged for accounting

purposes, comprising the US$400 million of Subordinated Notes due

2012, which were not hedged and which were redeemed in December

2009, and US$350 million of Senior Notes due 2038.

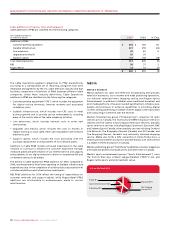

Debt Issuance Costs

During 2010, we recorded debt issuance costs of $10 million due to the

transaction costs incurred in connection with the $1.7 billion of debt

issuances,includingthe$800millionof6.11%SeniorNotesdue2040

issuedonAugust25,2010andthe$900millionof4.70%SeniorNotes

due 2020 issued on September 29, 2010.

During 2009, we recorded debt issuance costs of $11 million due to the

transaction costs incurred in connection with the $2.0 billion of debt

issuances,includingthe$1.0billionof5.80%SeniorNotesdue2016

issuedonMay26,2009andthe$500millionof5.38%SeniorNotesdue

2019 and $500 million of 6.68% Senior Notes due 2039 issued on

November 4, 2009.

Interest on Long-Term Debt

The $22 million increase in interest expense during 2010, compared to

2009, is primarily due to the increase in our long-term debt through

December 31, 2010, compared to December 31, 2009, including the

impact of Derivatives, partially offset by the decrease in the weighted-

average interest rate on long-term debt at December 31, 2010 compared

to December 31, 2009, largely due to refinancing activity. See the

section entitled “Liquidity and Capital Resources”.

Operating Income

The increase in our operating income compared to the prior year is due

to the growth in revenue of $455 million offset by the increase of

operating expenses of $122 million. See the detailed discussion on

respective segment results included in this section entitled “Segment

Review” above.

Impairment Losses on Goodwill, Intangible Assets and Other

Long-Term Assets

In the fourth quarter of 2010, we determined that the fair value of a

radio station licence was lower than its carrying value. This primarily

resulted from the weakening of advertising revenues in a local market.

As a result, we recorded a non-cash impairment charge of $6 million

related to the radio licence. In the fourth quarter of 2009, we recorded

a non-cash impairment charge of $4 million related to a similar

situation.

Also in the fourth quarter of 2009, we recorded an impairment charge

of $14 million related to our OMNI television network with the

following components: $1 million related to the broadcast licences and

$13 million related to other long-lived assets.

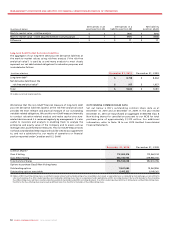

Depreciation and Amortization Expense

The decrease in depreciation and amortization expense for the year

ended December 31, 2010, over 2009, primarily reflects a decrease in

amortization of intangible assets resulting from certain intangible

assets that have now been fully amortized, partially offset by the $1.8

billion of additions to PP&E during 2010.