Rogers 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

66 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

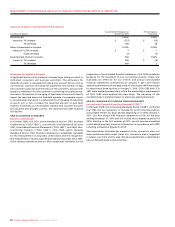

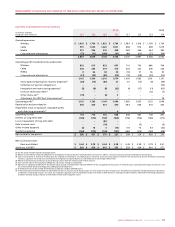

Impact of Changes in Pension-Related Assumptions

(In millions of dollars)

Accrued Benefit Obligation at

End of Fiscal 2010

Pension Expense

Fiscal 2010

Discount rate 5.60% 7.20%

Impactof:1%increase $ (137) $ (15)

1%decrease 165 18

Rate of compensation increase 3.00% 3.00%

Impactof:0.25%increase $ 7 $ 1

0.25%decrease (7) (1)

Expected rate of return on assets N/A 7.00%

Impactof:1%increase N/A $ (5)

1%decrease N/A 5

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit to

individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such as

our historical collection and write-off experience, the number of days

the customer is past due and the status of the customer’s account with

respect to whether or not the customer is continuing to receive service.

As a result, fluctuations in the aging of subscriber accounts will directly

impact the reported amount of bad debt expense. For example, events

or circumstances that result in a deterioration in the aging of subscriber

accounts will in turn increase the reported amount of bad debt

expense. Conversely, as circumstances improve and customer accounts

are adjusted and brought current, the reported bad debt expense

will decline.

NEW ACCOUNTING STANDARDS

Business Combinations

In October 2008, the CICA issued Handbook Section 1582, Business

Combinations (“CICA 1582”), concurrently with Handbook Sections

1601, Consolidated Financial Statements (“CICA 1601”), and 1602, Non-

controlling Interests (“CICA 1602”). CICA 1582, which replaces

Handbook Section 1581, Business Combinations, establishes standards

for the measurement of a business combination and the recognition

and measurement of assets acquired and liabilities assumed. CICA 1601,

which replaces Handbook Section 1600, establishes standards for the

preparation of consolidated financial statements. CICA 1602 establishes

guidance for the treatment of non-controlling interests. These new

standards are effective for our interim and annual consolidated

financial statements commencing on January 1, 2011 with earlier

adoption permitted as of the beginning of a fiscal year. We have chosen

to adopt these three sections on January 1, 2010. CICA 1582 and CICA

1601 were applied prospectively, while the presentation requirements

of CICA 1602 were applied retrospectively. The adoption of the

standards had no material impact on previously reported amounts.

RECENT CANADIAN ACCOUNTING PRONOUNCEMENTS

International Financial Reporting Standards (“IFRS”)

In February 2008, the Accounting Standards Board (“AcSB”) confirmed

that IFRS will be mandatory in Canada for profit-oriented publicly

accountable entities for fiscal periods beginning on or after January 1,

2011. Our first annual IFRS financial statements will be for the year

ending December 31, 2011 and will include the comparative period of

2010. Starting in the first quarter of 2011, we will provide unaudited

consolidated quarterly financial information in accordance with IFRS

including comparative figures for 2010.

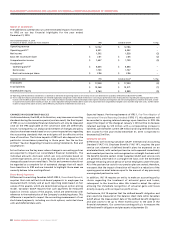

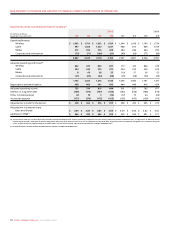

The table below illustrates key elements of our conversion plan, our

major milestones and current status. Our conversion plan is organized

in phases over time and by area. We have substantially completed all

per our detailed project plan as follows: