Rogers 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 69

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

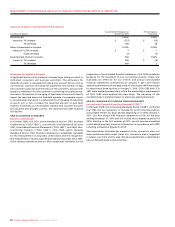

Also, IAS 19 limits the amount that can be recognized as an asset on the

statement of financial position to the present value of available

contribution reductions or refunds plus unrecognized actuarial losses

and unrecognized past service costs. This restriction is expected to

apply to one of our pension plans at the date of transition further

reducing the pension asset.

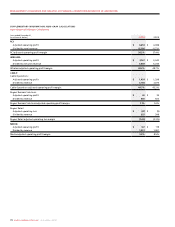

Expected impact: We expect the impact of these changes at January 1,

2010 will be to decrease retained earnings by $174 million offset by a

decrease in other long-term assets of $121 million and an increase in

other long-term liabilities of $53 million. Net income for the year ended

December 31, 2010 is expected to increase by $5 million. Other

comprehensive income for the year ended December 31, 2010

is expected to decrease by $80 million, due to actuarial losses

being recognized.

Borrowing Costs

Differences from existing Canadian GAAP: IAS 23, Borrowing Costs

(“IAS 23”), requires the capitalization of borrowing costs directly

attributable to the acquisition, construction or production of a

qualifying asset as part of the cost of that asset. Under Canadian GAAP,

we elected the accounting policy choice to expense these costs as

incurred.

Expected impact: IFRS 1 provides an election that permits application

of the requirements of IAS 23 prospectively from the date of transition,

January 1, 2010; therefore there is no change to the opening IFRS

balance sheet. We expect net income for the year ended December 31,

2010 will increase by $3 million.

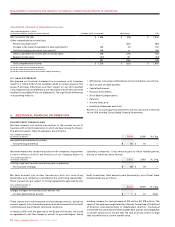

Fixed Assets: Componentization

Differences from existing Canadian GAAP: IAS 16, Property, Plant and

Equipment (“IAS 16”) requires an entity to identify the significant

component parts of its items of PP&E and depreciate those parts over

their respective useful lives. Canadian GAAP only requires

componentization to the extent practicable. We have identified a small

number of assets with significant component parts that were not

depreciated separately under Canadian GAAP.

Expected impact: Per the requirements of IFRS 1, this adjustment will

be recorded in opening retained earnings upon transition to IFRS. We

expect the impact of the change at January 1, 2010 will be to decrease

retained earnings by $11 million offset by a corresponding decrease in

property, plant & equipment. Net income for the year ended December

31, 2010 is expected to decrease by $2 million.

Joint Ventures

Differences from existing Canadian GAAP: IAS 31, Interests in Joint

Ventures (“IAS 31”), currently provides us with a policy choice to

account for joint ventures using either proportionate consolidation or

the equity method. The IASB is currently considering Exposure Draft 9,

Joint Arrangements (“ED 9”), that is intended to modify IAS 31. The

IASB has indicated that it expects to issue a new standard to replace IAS

31 in early 2011. Currently, under Canadian GAAP, we proportionately

account for interests in joint ventures. ED 9 proposes to eliminate the

option to proportionately consolidate such interests that exist in IAS 31,

and require an entity to recognize its interest in a joint venture, using

the equity method. Consequently, we expect to adopt the equity

method upon transition to IFRS to minimize the impact of the new

standard in the post transition period. The impact of using the equity

method is anticipated to result in reductions of the opening balances

for current assets, property, plant and equipment, intangible assets

and current liabilities with an offsetting increase in investments, with

no impact to the opening retained earnings balance.

In accordance with Canadian GAAP, the Company had previously

recorded a deferred gain in relation to the contribution of certain

assets to one of its joint ventures. The portion of this gain relating to

the other venturer’s interest in the joint venture is being amortized to

income over a seven-year period. Under IFRS, the Company would have

recognized the portion of the gain relating to the other venturer’s

interest in the joint venture fully into income at the time the

contribution was made.

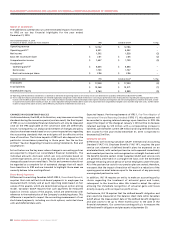

Expected impact: While the change from proportionate consolidation

to equity accounting for the Company’s joint ventures will not impact

opening retained earnings, nor will it impact net income, it is expected

to decrease operating revenue by $41 million for the year ended

December31,2010. The change is also expected to decrease operating

profit and adjusted operating profit by $22 million for the year ended

December 31, 2010. Also, the treatment of the deferred gain associated

with the contribution of certain assets to one of the Company’s joint

ventures is expected to result in an increase in retained earnings at

January 1, 2010 of $15 million with an offsetting decrease to other

long-term liabilities. As a result, net income is expected to decrease by

approximately $4 million for the year ended December 31, 2010.

Financial Instruments: Transaction Costs

Differences from existing Canadian GAAP: IAS 39, Financial Instruments:

Recognition and Measurement (“IAS 39”), requires that transaction

costs incurred upon initial acquisition of a financial instrument be

deferred and amortized into profit and loss over the life of the

instrument. Under Canadian GAAP these costs are recognized

immediately in net income.

Expected impact: Per the requirements of IFRS 1, this adjustment will

be recorded in opening retained earnings upon transition to IFRS. We

expect the impact of the change at January 1, 2010 will be to increase

retained earnings by $58 million with an offsetting decrease to long-

term debt. Net income for the year ended December 31, 2010 is

expected to decrease by $3 million.

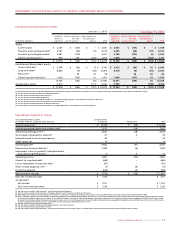

Financial Instruments: Hedge Accounting

Differences from existing Canadian GAAP: When assessing hedge

effectiveness under IAS 39, we will be required to include in the test

the risk that the parties to the hedging instrument will default by

failing to make payment. Under Canadian GAAP, we elected not to

include credit risk in the hedge effectiveness tests. Upon transition to

IFRS, we intend to continue to apply hedge accounting to all of our

hedging arrangements for which Canadian GAAP hedge accounting is

applied and that meet the IFRS hedge accounting criteria, including

passing the revised effectiveness tests.

Expected impact: While the change will not impact overall

shareholders’ equity, it is expected to increase retained earnings by $7

million and correspondingly decrease the hedging equity reserve by $7

million at January 1, 2010. Net income for the year ended December 31,

2010 is expected to decrease by $6 million. The change to net income is

offset by a corresponding impact to other comprehensive income.

Customer Loyalty Programs

Differences from existing Canadian GAAP: IFRIC 13 Customer Loyalty

Programmes (“IFRIC 13”) requires a revenue approach in accounting

for customer loyalty programs. Canadian GAAP does not provide

specific guidance on accounting for customer loyalty programs. For

Canadian GAAP, we have adopted a liability approach for our customer

loyalty program offered to Fido subscribers. The current policy is to

classify the liability for loyalty points as an accrued liability on the

balance sheet and to record the net cost of the program in equipment

revenue. The liability is initially recorded at the face value of the

loyalty awards granted and subsequently adjusted based on

redemption rates. The application of IFRIC 13 is expected to result in a

reclassification of revenue between the network (decrease) and

equipment (increase) categories as well as a reclassification on the

balance sheet for the deferred revenue balance from accrued liabilities

to unearned revenue. Furthermore, we will also be required to defer a

portion of the revenue for the initial sales transaction in which the

awards are granted based on the fair value of the awards granted.