Rogers 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

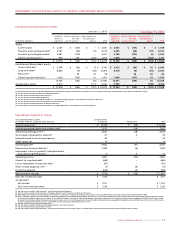

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

72 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

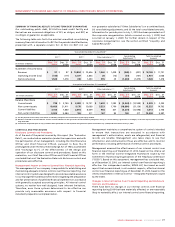

U.S. GAAP DIFFERENCES

We prepare our financial statements in accordance with Canadian

GAAP. U.S. GAAP differs from Canadian GAAP in certain respects. The

areas of principal differences and their impact on our 2010 Audited

Consolidated Financial Statements are described in Note 25 to the 2010

Audited Consolidated Financial Statements. The significant differences

in accounting relate to:

• Differencesinbusinesscombinationsandconsolidationaccounting;

• GainonSaleofCableSystems;

• CapitalizedInterest;

• FinancialInstruments;

• Stock-BasedCompensation;

• Pensions;

• IncomeTaxes;and

• InstallationRevenuesandCosts.

Recent U.S. accounting pronouncements are also discussed in Note 25

to the 2010 Audited Consolidated Financial Statements.

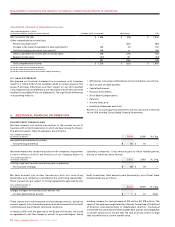

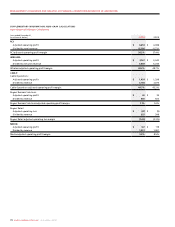

6. ADDITIONAL FINANCIAL INFORMATION

RELATED PARTY TRANSACTIONS

We have entered into certain transactions in the normal course of

business with certain broadcasters in which we have an equity interest.

The amounts paid to these broadcasters are as follows:

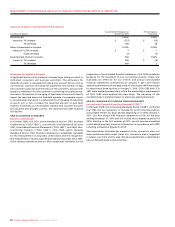

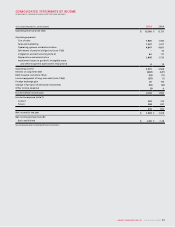

Consolidated statement of comprehensive income:

(1) See the section entitled “Employee Benefits”.

(2) See the section entitled “Private Investments”.

(3) See the section entitled “Financial Instruments: Hedge Accounting”.

Year ended Decemeber 31, 2010

(In millions of dollars, except per share amounts) Canadian GAAP, as recorded Adjustments IFRS

Net income for the year $ 1,528 $ (26) $ 1,502

Other comprehensive income (loss):

Pension actuarial losses(1) – (80) (80)

Increase in fair value of available-for-sale investments(2) 104 (2) 102

Cash flow hedging derivative instruments(3) 134 6 140

Other comprehensive income before income taxes 238 (76) 162

Related income taxes (37) 20 (17)

201 (56) 145

Total comprehensive income $ 1,729 $ (82) $ 1,647

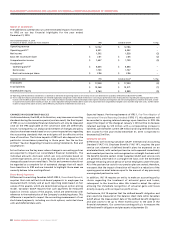

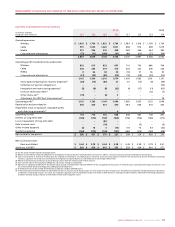

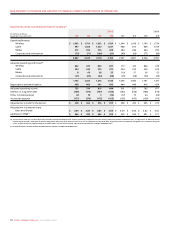

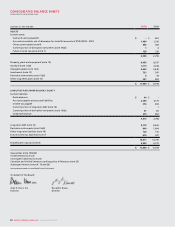

Years ended December 31,

(In millions of dollars) 2010 2009 %Chg

Fees paid to broadcasters accounted

for by the equity method $ 16 $ 16 –

Years ended December 31,

(In millions of dollars) 2010 2009 %Chg

Printing, legal services and commissions paid on premiums

for insurance coverage $ 39 $ 39 –

We have entered into certain transactions with companies, the partners

or senior officers of which are Directors of our Company and/or its

subsidiary companies. Total amounts paid to these related parties,

directly or indirectly, are as follows:

Years ended December 31,

(In millions of dollars) 2010 2009 %Chg

Charges to Rogers for business use of aircraft, net

of other adminstrative services $ – $ (1) (100)

We have entered into certain transactions with our controlling

shareholder and companies controlled by the controlling shareholder.

These transactions are subject to formal agreements approved by the

Audit Committee. Total amounts paid (received) by us to (from) these

related parties are as follows:

These transactions are measured at the exchange amount, being the

amount agreed to by the related parties and are reviewed by the Audit

Committee and are at market terms and conditions.

In January 2010, with the approval of the Board of Directors, we closed

an agreement to sell the Company’s aircraft to a private Rogers’ family

holding company for cash proceeds of $19 million (US $18 million). The

terms of the sale were negotiated by a Special Committee of the Board

of Directors comprised entirely of independent directors. The Special

Committee was advised by several independent parties knowledgeable

in aircraft valuations to ensure that the sale price was within a range

that was reflective of current market value.