Rogers 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 119

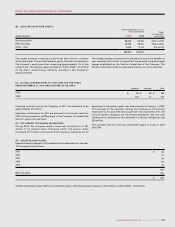

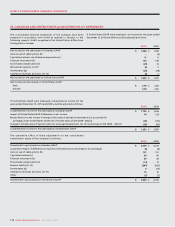

(K) PENSIONS:

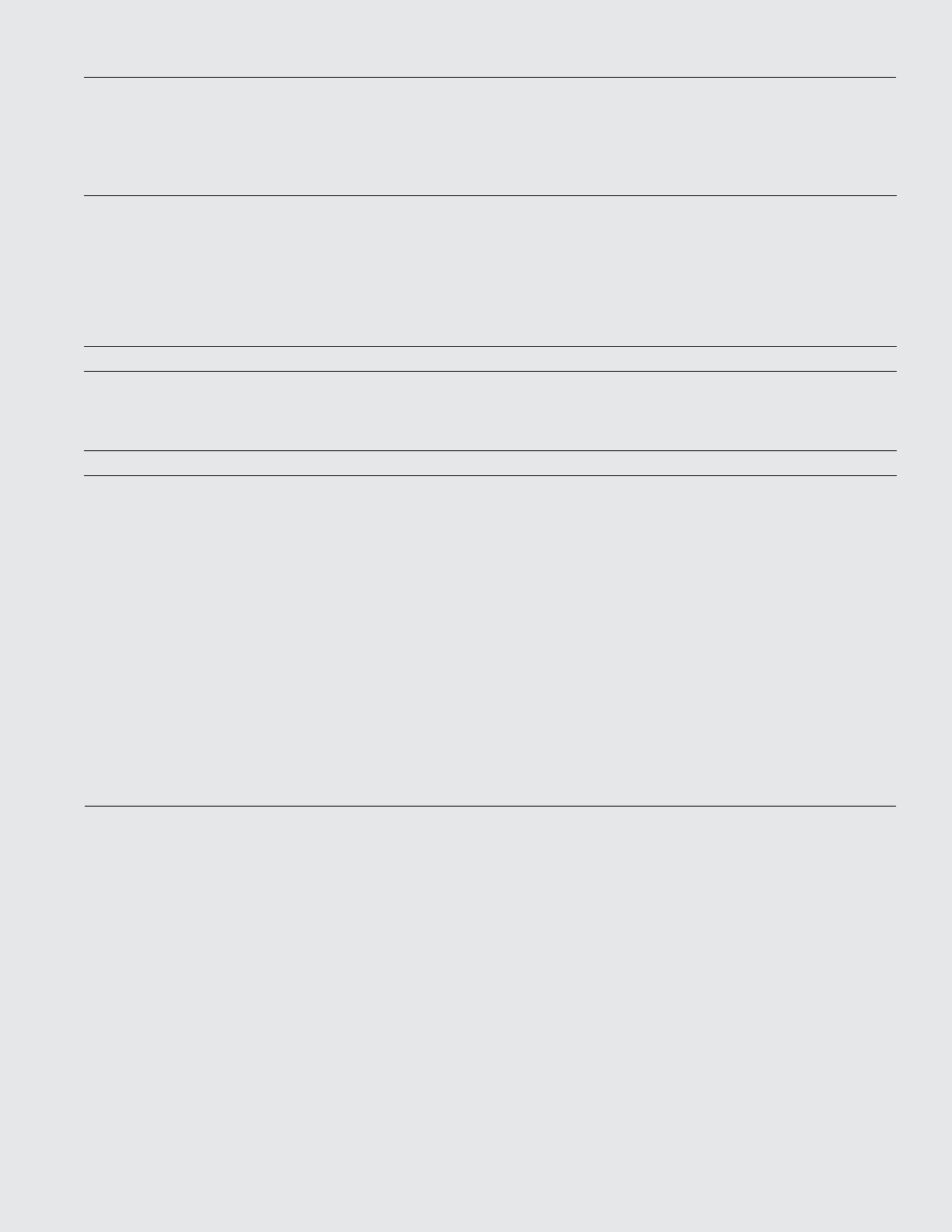

The following summarizes the additional disclosures required and

different pension-related amounts recognized or disclosed in the

Company’s accounts under United States GAAP:

2010 2009

Current service cost – employer portion $ 28 $ 16

Interest cost 37 41

Expected return on plan assets (40) (39)

Settlement of pension obligations –30

Amortization:

Transitional asset –(6)

Realized gains included in income 22

Net actuarial loss 94

Net periodic pension cost under United States GAAP $ 36 $ 48

Accrued benefit asset under Canadian GAAP $ 163 $ 134

One-time adjustment for change in measurement period (6) (6)

Cumulative periodic pension cost difference (2) 3

Accumulated other comprehensive loss under United States GAAP, on a pre-tax basis (231) (159)

Net amount recognized in the consolidated balance sheets under United States GAAP $ (76) $ (28)

In addition to the amounts disclosed above, under United States GAAP, the

net amount recognized in the consolidated balance sheets related to the

Company’s supplemental unfunded pension benefits for certain executives

was $36 million (2009 – $32 million). The total accumulated other

comprehensive loss associated with the supplemental plan amounts to $5

million (2009 – $3 million), on a pre-tax basis.

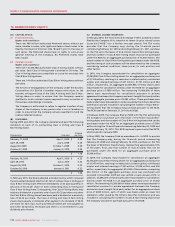

(L) RECENT UNITED STATES ACCOUNTING PRONOUNCEMENTS:

In September 2009, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standards Update 2009-13, Revenue Arrangements

with Multiple Deliverables (Topic 605), which addresses some aspects of

the accounting by a vendor for arrangements under which it will perform

multiple revenue-generating activities. This update is effective for the

Company’s interim and annual consolidated financial statements

commencing on January 1, 2011, with earlier adoption permitted as of the

beginning of a fiscal year. The Company is assessing the impact of the new

standard on its consolidated financial statements.

In February 2010, the FASB issued Update No. 2010-09, Subsequent Events

(Topic 855). This update removes the requirement for Securities Exchange

Commission filers to disclose the date financial statements are available to

be issued. It required the disclosure of the date through which an entity

has evaluated subsequent events to be the date the financial statements

were issued. The Company recognized the effects of events or transactions

that occur after the balance sheet date but before financial statements are

issued (“subsequent events”) if there is evidence that conditions related to

the subsequent event existed at the date of the balance sheet, including

the impact of such events on management’s estimates and assumptions

used in preparing the financial statements. Other significant subsequent

events that are not recognized in the financial statements are disclosed in

the notes to the consolidated financial statements.

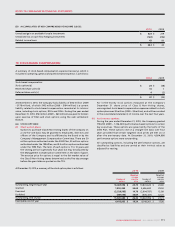

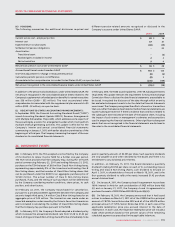

(A) In February 2011, the TSX accepted a notice filed by the Company

of its intention to renew its prior NCIB for a further one-year period.

The TSX notice provides that the Company may, during the 12-month

period commencing February 22, 2011 and ending February21, 2012,

purchase on the TSX the lesser of 39.8 million Class B Non-Voting shares,

representing approximately 9% of the issued and outstanding Class B

Non-Voting shares, and that number of Class B Non-Voting shares that

can be purchased under the NCIB for an aggregate purchase price of

$1,500 million. The actual number of Class B Non-Voting shares

purchased, if any, and the timing of such purchases will be determined

by the Company considering market conditions, share prices, its cash

position, and other factors.

On February 22, 2011, the Company repurchased for cancellation,

pursuant to a private placement agreement between the Company and

an arm’s-length third party, 1.4 million Class B Non-Voting shares for an

aggregate price of $45 million. The transaction was made under an

issuer bid exemption order issued by the Ontario Securities Commission

and is included in calculating the number of Class B Non-Voting shares

that the Company may purchase pursuant to the NCIB.

(B) In February 2011, the Company’s Board adopted a dividend policy

which increases the annualized dividend rate from $1.28 to $1.42 per

Class A Voting and Class B Non-Voting share effective immediately to be

paid in quarterly amounts of $0.355 per share. Such quarterly dividends

are only payable as and when declared by the Board and there is no

entitlement to any dividends prior thereto.

In addition, on February 15, 2011, the Board declared a quarterly

dividend totalling $0.355 per share on each of its outstanding Class A

Voting and Class B Non-Voting shares, such dividend to be paid on

April1, 2011, to shareholders of record on March 18, 2011, and is the

first quarterly dividend to reflect the newly increased $1.42 per share

annual dividend level.

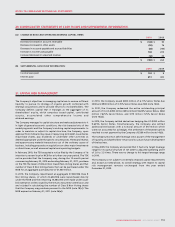

(C) On January 4, 2011, the Company closed its agreement to purchase

100% interest in Atria for cash consideration of $425 million (note 4(b)

(i)) and on January 31, 2011, the Company closed its agreements to

purchase the assets of BOB-FM and BOUNCE (note 4(b)(ii)).

(D) On February 18, 2011, the Company announced that it had issued

notices to redeem on March 21,2011 all of the US$350 million principal

amount of 7.875% Senior Notes due 2012 and all of the US$470 million

principal amount of 7.25% Senior Notes due 2012, in each case at the

applicable redemption price plus accrued interest to the date of

redemption. In each case, the respective redemption price will include a

make whole premium based on the present values of the remaining

scheduled payments as prescribed in the applicable indenture.

26. SUBSEQUENT EVENTS: