Rogers 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 45

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Stock-based Compensation

Our employee stock option plans attach cash-settled share appreciation

rights (“SARs”) to all new and previously granted options. The SAR

feature allows the option holder to elect to receive in cash an amount

equal to the intrinsic value, being the excess market price of the Class B

Non-Voting share over the exercise price of the option, instead of

exercising the option and acquiring Class B Non-Voting shares. All

outstanding stock options are classified as liabilities and are carried at

their intrinsic value, as adjusted for vesting, measured as the difference

between the current stock price and the option exercise price. The

intrinsic value of the liability is marked-to-market each period and is

amortized to expense over the period in which the related services are

rendered, which is usually the graded vesting period, or, as applicable,

over the period to the date an employee is eligible to retire, whichever

is shorter.

The liability for stock-based compensation expense is recorded based

on the intrinsic value of the options, as described above, and the

expense is impacted by the change in the price of RCI’s Class B Non-

Voting shares during the life of the option. At December 31, 2010, we

had a liability of $162 million (2009 – $178 million) related to stock-

based compensation recorded at its intrinsic value, including stock

options, restricted share units and deferred share units. In the year

ended December 31, 2010, $58 million (2009 – $63 million) was paid to

holders of stock options, restricted share units and deferred share units

upon exercise using the SAR feature.

In March 2010, the federal budget introduced proposed changes that

impact the tax deductibility of cash-settled stock options. The proposed

legislative changes were enacted in December 2010. As a result, the

Company recorded an income tax charge of $35 million to reduce

future tax assets previously recognized with respect to its stock option

related liabilities.

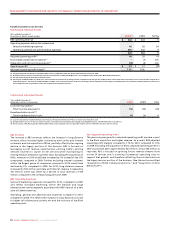

A summary of stock-based compensation expense is as follows:

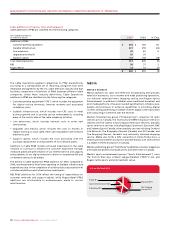

Integration and Restructuring Expenses

During the year ended December 31, 2010, we incurred $40 million of

integration and restructuring expenses to improve our cost structure

related to i) severances resulting from the targeted restructuring of our

employee base ($21 million); ii) restructuring expenses related to the

outsourcing of certain information technology functions ($9 million);

iii) acquisition transaction costs incurred and the integration of

acquired businesses and related restructuring ($5 million); and iv) the

closure of certain retail stores ($5 million).

During the year ended December 31, 2009, we incurred $117 million of

integration and restructuring expenses related to: i) severances

resulting from the targeted restructuring of our employee base to

combine our Cable and Wireless businesses into a communications

organization and to improve our cost structure in light of the then

current economic and competitive conditions ($87 million); ii)

severances and restructuring expenses related to the outsourcing of

certain information technology functions ($23 million); iii) the

integration of acquired businesses and related restructuring ($3

million); and iv) the closure of certain retail stores ($4 million).

Other Items

During the year ended December 31, 2010, we recorded $14 million of

net adjustments related to the resolution of obligations and accruals

relating to prior periods.

Adjusted Operating Profit

As discussed above, Wireless, Cable and Media contributed to the

increase in adjusted operating profit for the year ended

December31,2010 compared to 2009.

Consolidated adjusted operating profit increased to $4,653 million in

2010, compared to $4,388 million in 2009. Adjusted operating profit for

2010 and 2009, respectively, excludes: (i) stock-based compensation

expense (recovery) of $47 million and $(33) million; (ii) integration and

restructuring expenses of $40 million and $117 million; (iii) other items

of $14 million and $nil; (iv) an adjustment for CRTC Part II fees related to

prior periods of $nil and $(61) million; (v) contract termination fees of

$nil and $19 million; and (vi) settlement of pension obligations of $nil

and $30 million.

For details on the determination of adjusted operating profit, which is

a non-GAAP measure, see the sections entitled “Supplementary

Information: Non-GAAP Calculations” and “Key Performance Indicators

and Non-GAAP Measures”.

Employees

Employee remuneration represents a material portion of our expenses.

At December 31, 2010, we had approximately 25,100 (2009 – 25,900)

full-time equivalent employees (“FTEs”) across all of our operating

groups, including our shared services organization and corporate

office, which was a slight decrease from the level at December 31, 2009.

Reductions associated with operational efficiencies and the integration

of our Cable and Wireless organizations and reductions in Media

associated with improvements to its cost structure, were partially offset

by increases in our shared services staffing and customer facing

functions. Total remuneration costs incurred for employees (both full

and part-time) in 2010 was approximately $1,715 million, which is

unchanged from 2009. The amount of remuneration costs incurred for

employees decreased due to the number of FTEs compared to 2009, but

was offset by the increase in stock-based compensation expense to $47

million compared to a $33 million recovery in 2009, as a result of

fluctuations in the Company’s stock price.

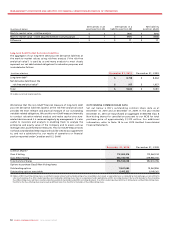

ADDITIONS TO PP&E

For details on the additions of PP&E for the Wireless, Cable and Media

segments, refer to the section entitled “Segment Review”.

Corporate Additions to PP&E

The corporate additions to PP&E included $133 million for the year

ended December 31, 2010 and $151 million for the year ended December

31, 2009, both of which related to spending on an enterprise-wide

billing and business support system initiative.

Stock-based Compensation Expense (Recovery)

Included in Operating, General and

Administrative Expenses

Years ended December 31,

(In millions of dollars) 2010 2009

Wireless $ 11 $ –

Cable 7(12)

Media 9(8)

Corporate 20 (13)

$ 47 $ (33)