Rogers 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 113

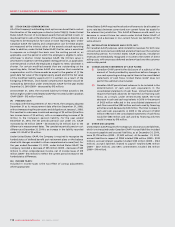

20. CONSOLIDATED STATEMENTS OF CASH FLOWS AND SUPPLEMENTAL INFORMATION:

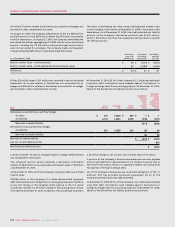

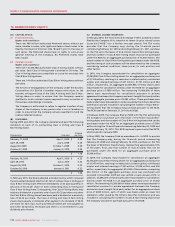

(A) CHANGE IN NON-CASH OPERATING WORKING CAPITAL ITEMS:

2010 2009

Decrease (increase) in accounts receivable $ (163) $ 93

Decrease (increase) in other assets (90) 76

Decrease in accounts payable and accrued liabilities (83) (155)

Increase in income taxes payable 168 205

Increase (decrease) in unearned revenue (12) 45

$ (180) $ 264

(B) SUPPLEMENTAL CASH FLOW INFORMATION:

2010 2009

Income taxes paid $ 152 $ 8

Interest paid 651 632

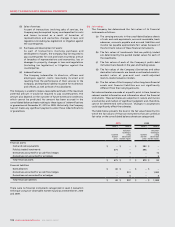

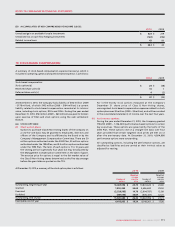

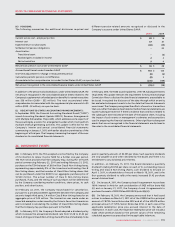

The Company’s objectives in managing capital are to ensure sufficient

liquidity to pursue its strategy of organic growth combined with

strategic acquisitions and to provide returns to its shareholders. The

Company defines capital that it manages as the aggregate of its

shareholders’ equity, which comprises issued capital, contributed

surplus, accumulated other comprehensive income and

retained earnings.

The Company manages its capital structure and makes adjustments to it

in light of general economic conditions, the risk characteristics of the

underlying assets and the Company’s working capital requirements. In

order to maintain or adjust its capital structure, the Company, upon

approval from its Board, may issue or repay long-term debt, issue shares,

repurchase shares, pay dividends or undertake other activities as

deemed appropriate under the specific circumstances. The Board reviews

and approves any material transactions out of the ordinary course of

business, including proposals on acquisitions or other major investments

or divestitures, as well as annual capital and operating budgets.

In February 2010, the TSX accepted a notice filed by the Company of its

intention to renew its prior NCIB for a further one-year period. The TSX

notice provides that the Company may, during the 12-month period

commencing February 22, 2010 and ending February 21, 2011, purchase

on the TSX the lesser of 43.6 million Class B Non-Voting shares and that

number of Class B Non-Voting shares that can be purchased under the

NCIB for an aggregate purchase price of $1,500 million.

In 2010, the Company repurchased an aggregate 37,080,906 Class B

Non-Voting shares, of which 22,600,906 were repurchased directly

under the NCIB and the remaining 14,480,000 were made under issuer

bid exemption orders issued by the Ontario Securities Commission and

are included in calculating the number of Class B Non-Voting shares

that the Company may purchase pursuant to the NCIB (note 18(c)). The

NCIB expired on February 21, 2011 (note 26(a)).

In 2010, the Company issued $800 million of 6.11% Senior Notes due

2040 and $900 million of 4.70% Senior Notes due 2020 (note 14(c)).

In 2010, the Company redeemed the entire outstanding principal

amount of its U.S.$490 million ($516 million) 9.625% Senior Notes, $460

million 7.625% Senior Notes, and $175 million 7.25% Senior Notes

(note 14(d)).

In 2010, the Company settled derivatives hedging the U.S.$490 million

9.625% Senior Notes. Simultaneously, the Company also settled

additional Derivatives with a notional amount of $10 million which

were not accounted for as hedges. The settlement of these Derivatives

resulted in a net payment by the Company of $269 million (note 14(d)).

The Company monitors debt leverage ratios as part of the management

of liquidity and shareholders’ return and to sustain future development

of the business.

In May 2009, the Company announced that it had set a target leverage

range for its capital structure of net debt to adjusted operating profit

of 2.0 to 2.5 times. There was no change to this target leverage range

in 2010.

The Company is not subject to externally imposed capital requirements

and, except as noted above, its overall strategy with respect to capital

risk management remains unchanged from the year ended

December31,2009.

21. CAPITAL RISK MANAGEMENT: