Rogers 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 27

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

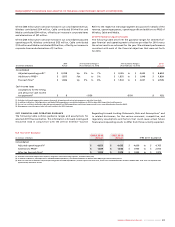

Wireless Operating Highlights For the Year Ended December31,2010

• Network revenue increased by 5% from 2009 while adjusted

operating profit increased by 4% during the same period, with

marginsfortheyearat48.2%.

• Subscribergrowthcontinuedin2010,withnetadditionsof466,000,

ofwhichapproximately68%werepostpaidsubscribers.

• Postpaidsubscribermonthlychurnwas1.18%in2010,comparedto

1.06%in2009.

• Postpaid monthly ARPU was relatively flat compared to 2009 at

$73.12, reflecting the impact of competitive intensity and declines in

roaming and out-of-plan usage revenues, which offset the significant

growth in wireless data revenue.

• Revenuesfromwirelessdataservicesgrewapproximately34%year-

over-year to $1,834 million in 2010 from $1,366 million in 2009, and

representedapproximately28%ofnetworkrevenuecomparedto

22%in2009.

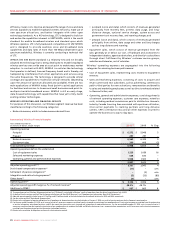

• Wirelessactivatedapproximately1.9millionsmartphonedevices

during the year, predominantly iPhone, BlackBerry and Android

devices.Approximately33%oftheseactivationswereforsubscribers

new toWireless and 67%beingforexisting Wirelesssubscribers

who upgraded to smartphones and generally committed to new

term contracts. Subscribers with smartphones now represent

approximately41%oftheoverallpostpaidsubscriberbase,upfrom

31%fromlastyear,andgenerateaverageARPUnearlytwicethatof

voice only subscribers.

• WirelessannouncedastrategicbusinessrelationshipwithTBayTel

to extend HSPA+ service across Northern Ontario giving Rogers

and TBayTel customers significantly expanded 3.5G coverage across

communities and major highway corridors covering an area of close

to 300,000 square kilometres.

• Wireless,throughits50%-ownedInukshukWirelessPartnership,

entered into an agreement to acquire from Craig Wireless

approximately 61 MHz of broadband radio service spectrum in the

2500 MHz to 2690 MHz frequency range across the provinces of

British Columbia and Manitoba, as well as between 6 MHz to 24 MHz

of miscellaneous spectrum in certain Manitoba markets.

• WirelessunveiledtheRogersHandsetProtectionGuaranteeprogram

for wireless customers. The program, a first from a Canadian wireless

service provider, provides a simple and cost effective replacement

service for customers whose devices have been lost, stolen or broken.

• WirelesslaunchedRogers’ExtremeTextMessagingservice,aNorth

American first, allowing wireless customers to personalize their

texting experience with signatures, distribution lists, blocking and

forwarding, making the texting experience as easy and feature-rich

as e-mail.

• Wirelessannouncedtheintroductionofanewwirelessbrandcalled

chatr which offers prepaid unlimited talk and text network services

within defined urban chatr zones.

• WirelesslaunchedthenextgenerationAppleiPhone4thatincludes

new features such as video calling, higher-resolution display, multi-

tasking and HD video recording, and also began offering wireless

service plans for Apple’s iPad for customers who want to take their

movies, TV shows, music, games and reading with them.

• WirelesscommencedaLTEwirelessnetworktechnicaltrialinthe

Ottawa area. LTE is a 4G wireless technology that enables network

speeds of up to 150 Mbps. The trial seeks to validate how LTE

technology performs across a variety of spectrum frequencies

in urban, suburban and rural environments, as well as actual

throughput speeds, performance quality and interoperability with

our existing HSPA+ network.

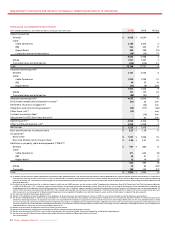

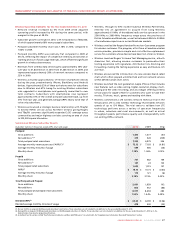

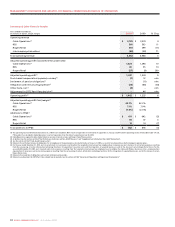

(Subscriber statistics in thousands, except ARPU, churn and usage) 2010 2009 Chg

Postpaid

Gross additions 1,330 1,377 (47)

Net additions (1)(2) 319 528 (209)

Total postpaid retail subscribers 7,325 6,979 346

Average monthly revenue per user (“ARPU”)(3) $ 73.12 $ 73.93 $ (0.81)

Average monthly minutes of usage 559 585 (26)

Monthly churn 1.18% 1.06% 0.12%

Prepaid

Gross additions 731 582 149

Net additions (2) 147 24 123

Total prepaid retail subscribers 1,652 1,515 137

ARPU(3) $ 16.10 $ 16.73 $ (0.63)

Average monthly minutes of usage 115 121 (6)

Monthly churn 3.18% 3.15% 0.03%

Total Postpaid and Prepaid

Gross additions 2,061 1,959 102

Net additions 466 552 (86)

Total postpaid and prepaid retail subscribers 8,977 8,494 483

Monthly churn 1.53% 1.44% 0.09%

Blended ARPU(3) $ 63.03 $ 63.59 $ (0.56)

Blended average monthly minutes of usage 478 500 (22)

Summarized Wireless Subscriber Results

(1) On July 9, 2010, we acquired 44,000 postpaid subscribers from Cityfone. These subscribers are not included in net additions for the year ended December 31, 2010.

(2) During 2010, we migrated 17,000 postpaid subscribers and 10,000 prepaid subscribers to TBayTel. These subscribers are not included in net additions for the year ended December 31, 2010 nor in the

determination of postpaid or prepaid monthly churn.

(3) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”. As calculated in the “Supplementary Information: Non-GAAP Calculations” section.