Rogers 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

64 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

services have been rendered, fees are fixed and determinable and

collectibility is reasonably assured.

Unearned revenue includes subscriber deposits, installation fees and

amounts received from subscribers related to services and subscriptions

to be provided in future periods.

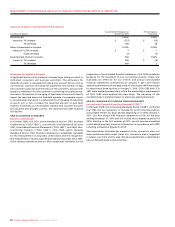

Subscriber Acquisition and Retention Costs

We operate within a highly competitive industry and generally incur

significant costs to attract new subscribers and retain existing

subscribers. All sales and marketing expenditures related to subscriber

acquisitions, retention and contract renewals, such as commissions and

the cost associated with the sale of customer premises equipment, are

expensed as incurred.

A large percentage of the subscriber acquisition and retention costs,

such as equipment subsidies and commissions, are variable in nature

and directly related to the acquisition or renewal of a subscriber. In

addition, subscriber acquisition and retention costs on a per-subscriber-

acquired basis fluctuate based on the success of promotional activity

and the seasonality of the business. Accordingly, if we experience

significant growth in subscriber activations or renewals during a period,

expenses for that period will increase.

Capitalization of Direct Labour and Overhead

During construction of new assets, direct costs plus a portion of

applicable overhead costs are capitalized. Repairs and maintenance

expenditures are charged to operating expenses as incurred.

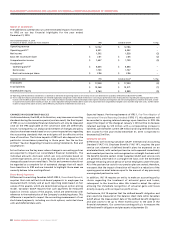

CRITICAL ACCOUNTING ESTIMATES

This MD&A has been prepared with reference to our 2010 Audited

Consolidated Financial Statements and Notes thereto, which have been

prepared in accordance with Canadian GAAP. The preparation of these

financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets, liabilities,

revenues and expenses, and the related disclosure of contingent assets

and liabilities. These estimates are based on management’s historical

experience and various other assumptions that are believed to be

reasonable under the circumstances, the results of which form the basis

for making judgments about the reported amounts of assets, liabilities,

revenue and expenses that are not readily apparent from other sources.

Actual results could differ from those estimates. We believe that the

accounting estimates discussed below are critical to our business

operations and an understanding of our results of operations or may

involve additional management judgment due to the sensitivity of the

methods and assumptions necessary in determining the related asset,

liability, revenue and expense amounts.

Determining the Fair Values of Assets Acquired and

Liabilities Assumed

The determination of the fair values of the tangible and intangible

assets acquired and the liabilities assumed in an acquisition involves

considerable judgment. Among other things, the determination of

these fair values involves the use of discounted cash flow analyses,

estimated future margins, estimated future subscribers, estimated

future royalty rates and the use of information available in the financial

markets. Refer to Note 4 of the 2010 Audited Consolidated Financial

Statements for acquisitions made during 2010. Should actual rates, cash

flows, costs and other items differ from our estimates, this may

necessitate revisions to the carrying value of the related assets and

liabilities acquired, including revisions that may impact net income in

future periods.

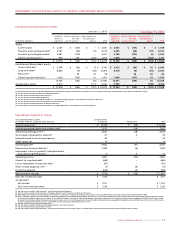

Useful Lives of PP&E

We depreciate the cost of PP&E over their respective estimated useful

lives. These estimates of useful lives involve considerable judgment. In

determining the estimates of these useful lives, we take into account

industry trends and company-specific factors, including changing

technologies and expectations for the in-service period of certain

assets. On an annual basis, we re-assess our existing estimates of useful

lives to ensure they match the anticipated life of the technology from a

revenue-producing perspective. If technological change happens more

quickly or in a different way than anticipated, we might have to reduce

the estimated life of PP&E, which could result in a higher depreciation

expense in future periods or an impairment charge to write down the

value of PP&E.

Capitalization of Direct Labour and Overhead

Certain direct labour and indirect costs associated with the acquisition,

construction, development or betterment of our networks are

capitalized to PP&E. The capitalized amounts are calculated based on

estimated costs of projects that are capital in nature, and are generally

based on a rate per hour. Although interest costs are permitted to be

capitalized during construction under Canadian GAAP, it is our policy

not to capitalize interest.

Accrued Liabilities

The preparation of financial statements requires management to make

estimates and assumptions that affect the reported amounts of accrued

liabilities at the date of the financial statements and the reported

amounts expensed during the year. Actual results could differ from

those estimates.

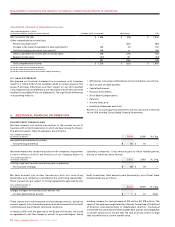

Amortization of Intangible Assets

We amortize the cost of finite-lived intangible assets over their

estimated useful lives. These estimates of useful lives involve

considerable judgment. During 2004 and 2005, the acquisitions of Fido,

Call-Net, the minority interests in Wireless and Sportsnet, together

with the consolidation of the Blue Jays, as well as the acquisitions of

Futureway and Citytv in 2007, Aurora Cable and channel m in 2008,

K-Rock and Outdoor Life Network in 2009, and Blink, Cityfone,

Kincardine and BV! Media in 2010, resulted in significant increases to

our intangible asset balances. Judgment is also involved in determining

that spectrum and broadcast licences have indefinite lives, and are

therefore not amortized.

The determination of the estimated useful lives of brand names

involves historical experience, marketing considerations and the nature

of the industries in which we operate. The useful lives of subscriber

bases are based on the historical churn rates of the underlying

subscribers and judgments as to the applicability of these rates going

forward. The useful lives of roaming agreements are based on estimates

of the useful lives of the related network equipment. The useful lives of

wholesale agreements and dealer networks are based on the

underlying contractual lives. The useful life of the marketing agreement

is based on historical customer lives. The determination of the

estimated useful lives of intangible assets impacts amortization

expense in the current period as well as future periods. The impact on

net income on a full-year basis of changing the useful lives of the finite-

lived intangible assets by one year is shown in the chart below.