Rogers 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

38 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

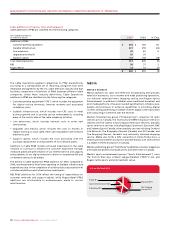

RBS Revenue

The increase in RBS revenues reflects the increase in long-distance

revenue, which includes higher volumes by both carrier and internal

customers, and the acquisition of Blink, partially offset by the ongoing

decline in the legacy portions of the business. RBS is focused on

leveraging on-net revenue opportunities utilizing Cable’s existing

network facilities to launch on-net services while maintaining its

existing medium enterprise customer base. Excluding the acquisition of

Blink,revenuefor2010wouldhaveincreasedby7%insteadofthe11%

as reported, compared to 2009. Further, excluding internal customers

within the Rogers group of companies, revenue for 2010 would have

declinedby3%,comparedto2009.For2010,long-distancerevenue

increased by $50 million and data and Internet revenue increased by

$21 million, which was offset by a decline in local revenues of $14

million, compared to the corresponding period of 2009.

RBS Operating Expenses

Sales and marketing expenses increased for 2010, compared to 2009,

and reflect increased marketing within the medium and large

enterprise and carrier segments associated with RBS’s launch of a new

suite of Ethernet services.

Operating, general and administrative expenses increased for 2010,

compared to 2009. This reflects the increase in long-distance costs due

to higher call volumes and country mix and the inclusion of the Blink

operating costs.

RBS Adjusted Operating Profit

The year-over-year growth in adjusted operating profit was due in part

to the Blink acquisition and higher revenue. As a result, RBS adjusted

operatingprotmarginsincreasedto7.1%for2010,comparedto7.0%

in 2009. Excluding the acquisition of Blink, adjusted operating profit for

2010 would have been approximately $30 million, versus $40 million as

reported. RBS is focused on growing future revenue streams from

on-net IP services and is incurring incremental operating costs to

support that growth, and therefore offsetting the cost declines from

the legacy services portion of the business. (See the sections entitled

“Acquisition of Blink Communications Inc.” and “Acquisition of Atria

Networks LP”).

(1) The operating results of Blink are included in RBS’s results of operations from the date of acquisition on January 29, 2010.

(2) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(3) See the section entitled “Stock-based Compensation”.

(4) For the year ended December 31, 2010, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base; and ii) acquisition transaction costs incurred and the integration of

acquired businesses. For the year ended December 31, 2009, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses

into a communications organization; and ii) the integration of acquired businesses.

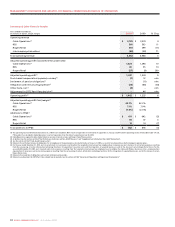

ROGERS BUSINESS SOLUTIONS

Summarized Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2010(1) 2009 %Chg

RBS operating revenue $ 560 $ 503 11

Operating expenses before the undernoted

Sales and marketing expenses 40 26 54

Operating, general and administrative expenses 480 442 9

520 468 11

Adjusted operating profit(2) 40 35 14

Stock-based compensation expense(3) –(1) n/m

Integration and restructuring expenses(4) (13) (3) n/m

Operating profit(2) $ 27 $ 31 (13)

Adjusted operating profit margin(2) 7.1% 7.0%

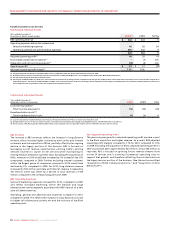

Summarized Subscriber Results

Years ended December 31,

(Subscriber statistics in thousands) 2010 2009 Chg

Local line equivalents(1)

Total local line equivalents 146 169 (23)

Broadband data circuits(2)(3)

Total broadband data circuits 42 36 6

(1) Local line equivalents include individual voice lines plus Primary Rate Interfaces (“PRIs”) at a factor of 23 voice lines each.

(2) Broadband data circuits are those customer locations accessed by data networking technologies including DOCSIS, DSL, E10/100/1000, OC 3/12 and DS 1/3.

(3) On January 29, 2010, RBS acquired 2,000 broadband data circuits acquired from its acquisition of Blink, and are reflected in the total amounts shown.