Rogers 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

90 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

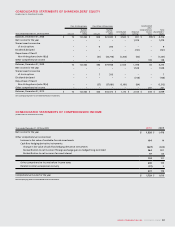

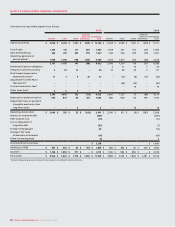

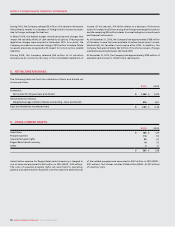

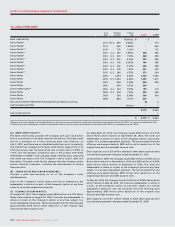

2010 2009

Wireless Cable Media

Corporate

items and

eliminations

Consolidated

totals Wireless Cable Media

Corporate

items and

eliminations

Consolidated

totals

Operating revenue $ 6,968 $ 4,052 $ 1,501 $ (335) $ 12,186 $ 6,654 $ 3,948 $ 1,407 $ (278) $ 11,731

Cost of sales 1,225 181 171 (57) 1,520 1,059 201 167 (47) 1,380

Sales and marketing 628 441 235 (77) 1,227 630 446 209 (78) 1,207

Operating, general and

administrative* 1,948 1,993 948 (103) 4,786 1,923 1,977 912 (56) 4,756

3,167 1,437 147 (98) 4,653 3,042 1,324 119 (97) 4,388

Settlement of pension obligations –––––311 15 130

Integration and restructuring 523 12 –40 33 46 35 3117

Stock-based compensation

expense (recovery)* 11 7 9 20 47 –(12) (8) (13) (33)

Adjustment for CRTC Part II

fees decision* ––––––(46) (15) –(61)

Contract termination fees* –––––– – 19 –19

Other items (net)* 5 5 4 – 14 –––––

3,146 1,402 122 (118) 4,552 3,006 1,325 73 (88) 4,316

Depreciation and amortization 650 807 64 124 1,645 660 808 63 199 1,730

Impairment losses on goodwill,

intangible assets and other

long-term assets – – 6 – 6 – – 18 –18

Operating income (loss) $ 2,496 $ 595 $ 52 $ (242) 2,901 $ 2,346 $ 517 $ (8) $ (287) 2,568

Interest on long-term debt (669) (647)

Debt issuance costs (10) (11)

Loss on repayment of

long-term debt (87) (7)

Foreign exchange gain 20 136

Change in fair value

of derivative instruments (16) (65)

Other income (expense) (1) 6

Income before income taxes $ 2,138 $ 1,980

Additions to PP&E $ 937 $ 662 $ 46 $ 194 $ 1,839 $ 865 $ 693 $ 62 $ 235 $ 1,855

Goodwill $ 1,146 $ 1,058 $ 911 $ – $ 3,115 $ 1,14 0 $ 982 $ 896 $ – $ 3,018

Total assets $ 8,506 $ 5,320 $ 1,918 $ 1,586 $ 17,330 $ 7,988 $ 5,055 $ 1,884 $ 2,091 $ 17,018

*Included with operating, general and administrative expenses in consolidated statements of income.

Information by reportable segment is as follows: