Rogers 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 77

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

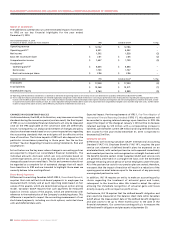

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of the end of the period covered by this report (the “Evaluation

Date”), we conducted an evaluation (under the supervision and with

the participation of our management, including the Chief Executive

Officer and Chief Financial Officer), pursuant to Rule 13a-15

promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), of the effectiveness of the design and

operation of our disclosure controls and procedures. Based on this

evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that as of the Evaluation Date such disclosure controls and

procedures were effective.

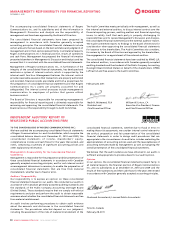

Management’s Report on Internal Control Over Financial Reporting

The management of our company is responsible for establishing and

maintaining adequate internal controls over financial reporting. Our

internal control system was designed to provide reasonable assurance

to our management and Board of Directors regarding the preparation

and fair presentation of published financial statements in accordance

with generally accepted accounting principles. All internal control

systems, no matter how well designed, have inherent limitations.

Therefore, even those systems determined to be effective can

provide only reasonable assurance with respect to financial

statement preparation and presentation.

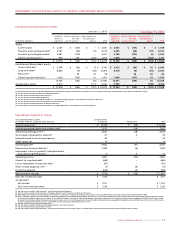

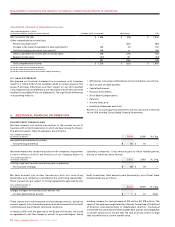

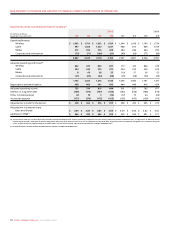

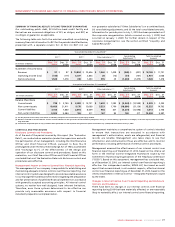

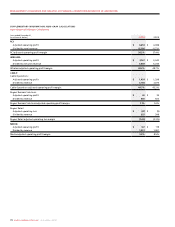

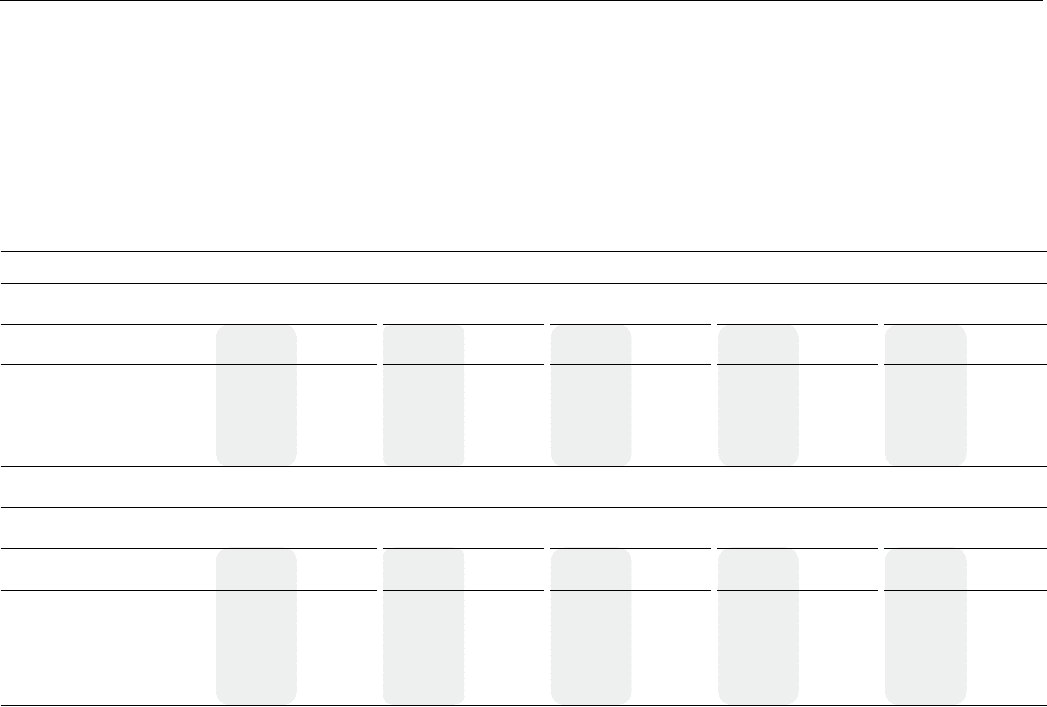

SUMMARY OF FINANCIAL RESULTS OF LONG-TERM DEBT GUARANTORS

Our outstanding public debt, $2.4 billion bank credit facility and

Derivatives are unsecured obligations of RCI, as obligor, and RCP, as

co-obligor or guarantor, as applicable.

The following table sets forth the selected unaudited consolidating

summary financial information for RCI for the periods identified below,

presented with a separate column for: (i) RCI; (ii) RCP; (iii) our

non-guarantor subsidiaries (“Other Subsidiaries”) on a combined basis;

(iv) consolidating adjustments; and (v) the total consolidated amounts.

Information for periods prior to July 1, 2010 has been presented as if

the corporate reorganization (which occurred on July 1, 2010) had

occurred on January 1, 2009. For further details in respect of the

corporate reorganization, see the section entitled “Liquidity and

Capital Resources”.

Management maintains a comprehensive system of controls intended

to ensure that transactions are executed in accordance with

management’s authorization, assets are safeguarded, and financial

records are reliable. Management also takes steps to see that

information and communication flows are effective and to monitor

performance, including performance of internal control procedures.

Management assessed the effectiveness of our internal control over

financial reporting as of December 31, 2010, based on the criteria set

forth in the Internal Control-Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission

(“COSO”). Based on this assessment, management has concluded that,

as of December 31, 2010, our internal control over financial reporting is

effective. Our independent auditor, KPMG LLP, has issued an audit

report that we maintained, in all material respects, effective internal

control over financial reporting as of December 31, 2010, based on the

criteria established in Internal Control – Integrated Framework issued

by the COSO.

Changes in Internal Control Over Financial Reporting and Disclosure

Controls and Procedures

There have been no changes in our internal controls over financial

reporting during 2010 that have materially affected, or are reasonably

likely to materially affect, our internal controls over financial reporting.

(1) For the purposes of this table, investments in subsidiary companies are accounted for by the equity method.

(2) Amounts recorded in current liabilities and non-current liabilities for the guarantors do not include any obligations arising as a result of being a guarantor or co-obligor, as the case may be, under any of RCI’s

long-term debt.

(3) Information for periods prior to July 1, 2010 has been presented as if the corporate reorganization (which occurred on July 1, 2010) had occurred on January 1, 2009.

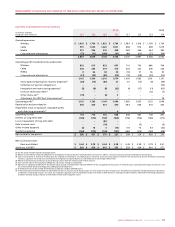

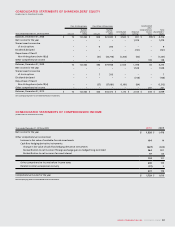

Years ended December 31 (unaudited)(3)

RCI(1)(2) RCP(1)(2) Other Subsidiaries (1)(2) Consolidating

Adjustments (1)(2)

Total Consolidated

Amounts

(In millions of dollars) Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009

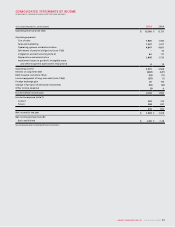

Statement of Income Data:

Revenue $ 97 $ 97 $ 10,894 $ 10,626 $ 1,560 $ 1,409 $ (365) $ (401) $ 12,186 $ 11,731

Operating Income (loss) (143) (111) 3,077 2,843 28 (13) (61) (151) 2,901 2,568

Net income (loss) 1,528 1,478 728 1,450 555 25 (1,283) (1,475) 1,528 1,478

As at period end December 31 (unaudited)(3)

RCI(1)(2) RCP(1)(2) Other Subsidiaries (1)(2) Consolidating

Adjustments (1)(2)

Total Consolidated

Amounts

(In millions of dollars) Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009 Dec. 31

2010 Dec. 31

2009

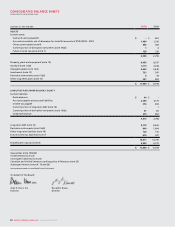

Balance Sheet Data

Current assets $ 738 $ 3,740 $ 2,838 $ 10,731 $ 1,692 $ 1,383 $ (3,263) $ (13,599) $ 2,005 $ 2,255

Non-current assets 19,688 21,411 9,178 12,688 5,323 1,790 (18,864) (21,126) 15,325 14,763

Current liabilities 3,156 7,860 2,094 8,059 964 427 (3,201) (13,598) 3,013 2,748

Non-current liabilities 9,905 9,484 106 211 167 85 180 217 10,358 9,997