Pizza Hut 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032309

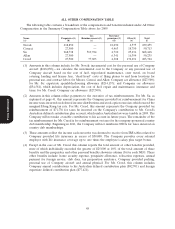

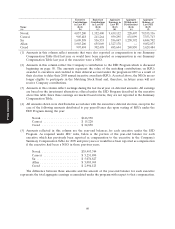

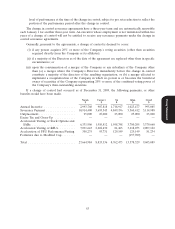

NONQUALIFIED DEFERRED COMPENSATION

Amounts reflected in the Nonqualified Deferred Compensation table below are provided for under

the Company’s Executive Income Deferral (‘‘EID’’) Program, an unfunded, unsecured deferred

compensation plan. For each calendar year, participants are permitted under this program to defer up to

85% of their base pay and/or 100% of their annual incentive award.

Deferred Program Investments. Amounts deferred under the EID Program may be invested in the

following phantom investment alternatives, which are (12 month investment returns are shown in

parenthesis):

• YUM! Stock Fund (11.02%*)

• YUM! Matching Stock Fund (11.02%*)

• S&P 500 Index Fund (26.64%)

• Bond Market Index Fund (5.93%) and

• Stable Value Fund (1.36%)

* assumes dividends are not reinvested

All of the phantom investment alternatives offered under the EID Program are designed to match the

performance of actual investments; that is, they provide market rate returns and do not provide for

preferential earnings. The S&P 500 index fund, bond market index fund and stable value fund are designed

to track the investment return of like-named funds offered under the Company’s 401(k) Plan. The YUM!

Stock Fund and YUM! Matching Stock Fund track the investment return of the Company’s common stock.

Participants may transfer funds between the investment alternatives on a quarterly basis except (1) funds

invested in the YUM! Stock Fund or YUM! Matching Stock Fund may not be transferred once invested in

these funds and (2) a participant may only elect to invest into the Matching Stock Fund at the time the

annual incentive deferral election is made. In the case of the Matching Stock Fund, participants who defer

their annual incentive into this fund, acquire additional phantom shares (called restricted stock units

(‘‘RSUs’’)) equal to 33% of the RSUs received with respect to the deferral of their annual incentive into

Proxy Statement

the Matching Stock Fund (the additional RSUs are referred to as ‘‘matching contributions’’). The RSUs

attributable to the matching contributions are allocated on the same day the RSUs attributable to the

annual incentive are allocated, which is the same day we make our annual stock appreciation right grants.

Amounts attributable to the matching contribution under the YUM! Matching Stock Fund are reflected in

column (c) below as contributions by the Company (and represent amounts actually credited to the NEO’s

account during 2009). Beginning with their 2009 annual incentive award, NEOs are no longer eligible to

participate in the Matching Stock Fund.

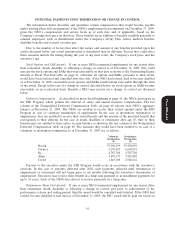

RSUs attributable to annual incentive deferrals into the Matching Stock Fund and matching

contributions vest on the second anniversary of the grant (or a change of control of the Company, if

earlier) and are payable as shares of YUM common stock pursuant to the participant’s deferral election.

Unvested RSUs held in a participant’s Matching Stock Fund account are forfeited if the participant

voluntarily terminates employment with the Company within two years of the deferral date. If a participant

terminates employment involuntarily, the portion of the account attributable to the matching contributions

is forfeited and the participant will receive an amount equal to the amount of the original amount

deferred. If a participant dies or becomes disabled during the restricted period, the participant fully vests

in the RSUs. Dividend equivalents are accrued during the restricted period but are only paid if the RSUs

vest. RSUs held by a participant who has attained age 65 with five years of service vest immediately. In the

case of a participant who has attained age 55 with 10 years of service, RSUs attributable to pre-2009 bonus

deferrals into the Matching Stock Fund vest immediately and RSUs attributable to the matching

contribution vest pro rata during the period beginning on the date of grant and ending on the first

anniversary of the grant and are fully vested on the first anniversary.

58