Pizza Hut 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

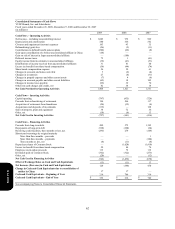

67

In connection with our plan to transform our U.S. business we began reflecting increased allocations of certain expenses

in our reported segment results during 2009 that were previously reported as unallocated and corporate General and

administrative (“G&A”) expenses. We believe the revised allocation better aligns costs with accountability of our

segment managers. These revised allocations are being used by our Chairman and Chief Executive Officer, in his role as

chief operating decision maker, in his assessment of operating performance. We have restated segment information for

the years ended December 27, 2008 and December 29, 2007 to be consistent with the current period presentation.

T

he following table summarizes the 2008 and 2007 impact of the revised allocations by segment:

Increase/(Decrease) 2008 2007

U.S. G&A $ 53 $ 54

YRI G&A 6 6

Unallocated and corporate G&A expenses (59 ) (60

)

These reclassifications had no effect on previously reported Net Income – YUM! Brands, Inc.

Franchise and License Operations. We execute franchise or license agreements for each unit which set out the terms of

our arrangement with the franchisee or licensee. Our franchise and license agreements typically require the franchisee or

licensee to pay an initial, non-refundable fee and continuing fees based upon a percentage of sales. Subject to our

approval and their payment of a renewal fee, a franchisee may generally renew the franchise agreement upon its

expiration.

The internal costs we incur to provide support services to our franchisees and licensees are charged to G&A expenses as

incurred. Certain direct costs of our franchise and license operations are charged to franchise and license expenses. These

costs include provisions for estimated uncollectible fees, rent or depreciation expense associated with restaurants we

sublease or lease to franchisees, franchise and license marketing funding, amortization expense for franchise related

intangible assets and certain other direct incremental franchise and license support costs.

We monitor the financial condition of our franchisees and licensees and record provisions for estimated losses on

receivables when we believe that our franchisees or licensees are unable to make their required payments. While we use

the best information available in making our determination, the ultimate recovery of recorded receivables is also

dependent upon future economic events and other conditions that may be beyond our control. Net provisions for

uncollectible franchise and license receivables of $11 million, $8 million and $2 million were included in Franchise and

license expenses in 2009, 2008 and 2007, respectively.

Revenue Recognition. Revenues from Company operated restaurants are recognized when payment is tendered at the

time of sale. The Company presents sales net of sales tax and other sales related taxes. Income from our franchisees and

licensees includes initial fees, continuing fees, renewal fees and rental income. We recognize initial fees received from a

franchisee or licensee as revenue when we have performed substantially all initial services required by the franchise or

license agreement, which is generally upon the opening of a store. We recognize continuing fees based upon a percentage

of franchisee and licensee sales and rental income as earned. We recognize renewal fees when a renewal agreement with

a franchisee or licensee becomes effective. We include initial fees collected upon the sale of a restaurant to a franchisee in

Refranchising (gain) loss.

Form 10-K