Pizza Hut 2009 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Franchise Loan Pool and Equipment Guarantees

We have provided a partial guarantee of approximately $15 million of a franchisee loan program used primarily to assist

franchisees in the development of new restaurants and, to a lesser extent, in connection with the Company’s historical

refranchising programs at December 26, 2009. We have also provided two letters of credit totaling approximately $23

million in support of the franchisee loan program. One such letter of credit could be used if we fail to meet our

obligations under our guarantee. The other letter of credit could be used, in certain circumstances, to fund our

participation in the funding of the franchisee loan program. The total loans outstanding under the loan pool were $54

million at December 26, 2009.

In addition to the guarantee described above, YUM has provided guarantees of $40 million on behalf of franchisees for

several equipment financing programs related to specific initiatives, the most significant of which was the purchase of

ovens by KFC franchisees for the launch of Kentucky Grilled Chicken. We have provided a letter of credit totaling $5

million which could be used if we fail to meet our obligations under our guarantee under one equipment financing

program. The total loans outstanding under these equipment financing programs were approximately $48 million at

December 26, 2009.

Unconsolidated Affiliates Guarantees

From time to time we have guaranteed certain lines of credit and loans of unconsolidated affiliates. At December 26,

2009 there are no guarantees outstanding for unconsolidated affiliates. Our unconsolidated affiliates had total revenues of

approximately $760 million for the year ended December 26, 2009 and assets and debt of approximately $365 million and

$40 million, respectively, at December 26, 2009.

Insurance Programs

We are self-insured for a substantial portion of our current and prior years’ coverage including workers’ compensation,

employment practices liability, general liability, automobile liability, product liability and property losses (collectively,

“property and casualty losses”). To mitigate the cost of our exposures for certain property and casualty losses, we make

annual decisions to self-insure the risks of loss up to defined maximum per occurrence retentions on a line by line basis or

to combine certain lines of coverage into one loss pool with a single self-insured aggregate retention. The Company then

purchases insurance coverage, up to a certain limit, for losses that exceed the self-insurance per occurrence or aggregate

retention. The insurers’ maximum aggregate loss limits are significantly above our actuarially determined probable

losses; therefore, we believe the likelihood of losses exceeding the insurers’ maximum aggregate loss limits is remote.

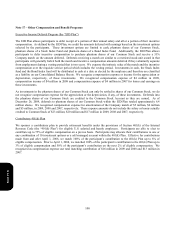

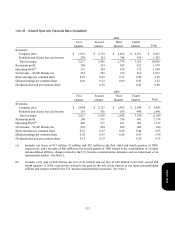

The following table summarizes the 2009 and 2008 activity related to our self-insured property and casualty reserves as of

December 26, 2009. The decrease in 2009 insurance expense primarily was driven by U.S. refranchising and improved

loss trends.

Beginning

Balance Expense Payments

Ending

Balance

2009 Activit

y

$ 196 44

(

67

)

$ 173

2008 Activity $ 197 68 (69

)

$ 196

In the U.S. and in certain other countries, we are also self-insured for healthcare claims and long-term disability for

eligible participating employees subject to certain deductibles and limitations. We have accounted for our retained

liabilities for property and casualty losses, healthcare and long-term disability claims, including reported and incurred but

not reported claims, based on information provided by independent actuaries.

Form 10-K