Pizza Hut 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

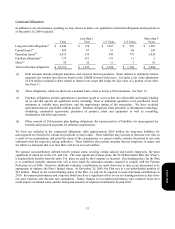

57

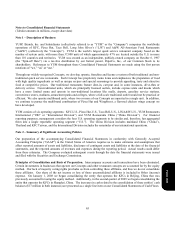

Stock Options and Stock Appreciation Rights Expense

Compensation expense for stock options and stock appreciation rights (“SARs”) is estimated on the grant date using a

Black-Scholes option pricing model. Our specific weighted-average assumptions for the risk-free interest rate, expected

term, expected volatility and expected dividend yield are documented in Note 16. Additionally, we estimate pre-vesting

forfeitures for purposes of determining compensation expense to be recognized. Future expense amounts for any

particular quarterly or annual period could be affected by changes in our assumptions or changes in market conditions.

We have determined that it is appropriate to group our awards into two homogeneous groups when estimating expected

term and pre-vesting forfeitures. These groups consist of grants made primarily to restaurant-level employees under our

Restaurant General Manager Stock Option Plan (the “RGM Plan”) and grants made to executives under our other stock

award plans. Historically, approximately 10% - 15% of total options and SARs granted have been made under the RGM

Plan.

Grants under the RGM Plan typically cliff vest after four years and grants made to executives under our other stock award

plans typically have a graded vesting schedule and vest 25% per year over four years. We use a single weighted-average

expected term for our awards that have a graded vesting schedule. We reevaluate our expected term assumptions using

historical exercise and post-vesting employment termination behavior on a regular basis. Based on the results of this

analysis, we have determined that five years and six years are appropriate expected terms for awards to restaurant level

employees and to executives, respectively.

Upon each stock award grant we reevaluate the expected volatility, including consideration of both historical volatility of

our stock as well as implied volatility associated with our traded options. We have estimated forfeitures based on

historical data. Based on such data, we believe that approximately 50% of all awards granted under the RGM Plan will be

forfeited and approximately 25% of all awards granted to above-store executives will be forfeited.

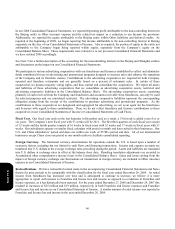

Income Taxes

At December 26, 2009, we had a valuation allowance of $187 million primarily to reduce our net operating loss and tax

credit carryforward benefits of $230 million, as well as our other deferred tax assets, to amounts that will more likely than

not be realized. The net operating loss and tax credit carryforwards exist in state and foreign jurisdictions that have

varying carryforward periods and restrictions on usage, including approximately $110 million in certain foreign

jurisdictions that may be carried forward indefinitely. The estimation of future taxable income in these jurisdictions and

our resulting ability to utilize net operating loss and tax credit carryforwards can significantly change based on future

events, including our determinations as to the feasibility of certain tax planning strategies. Thus, recorded valuation

allowances may be subject to material future changes.

As a matter of course, we are regularly audited by federal, state and foreign tax authorities. We recognize the benefit of

positions taken or expected to be taken in our tax returns in our Income tax provision when it is more likely than not (i.e. a

likelihood of more than fifty percent) that the position would be sustained upon examination by these tax authorities. A

recognized tax position is then measured at the largest amount of benefit that is greater than fifty percent likely of being

realized upon settlement. At December 26, 2009, we had $301 million of unrecognized tax benefits, $259 million of

which, if recognized, would affect the effective tax rate. We evaluate unrecognized tax benefits, including interest

thereon, on a quarterly basis to ensure that they have been appropriately adjusted for events, including audit settlements,

which may impact our ultimate payment for such exposures.

Additionally, we have not recorded the deferred tax impact for certain undistributed earnings from our foreign subsidiaries

totaling approximately $875 million at December 26, 2009, as we believe these amounts are indefinitely reinvested. If our

intentions were to change in the future based on a change in circumstances, deferred tax may need to be provided that

could materially impact income taxes.

See Note 19 for a further discussion of our income taxes.

Form 10-K