Pizza Hut 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

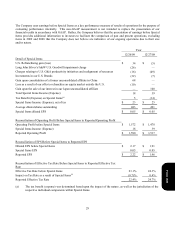

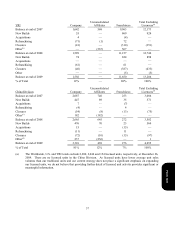

Impact of Foreign Currency Translation on Operating Profit

Changes in foreign currency exchange rates negatively impacted the translation of our foreign currency denominated

Operating Profit in our International Division by $56 million and positively impacted Operating Profit in our China

Division by $10 million for the year ended December 26, 2009. In the year ended December 27, 2008 our Operating

Profit in our International and China Divisions was positively impacted by $9 million and $42 million, respectively, by

changes in foreign currency exchange rates.

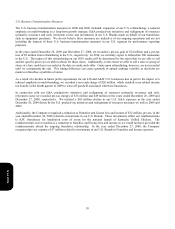

Pizza Hut South Korea Goodwill Impairment

As a result of a decline in future profit expectations for our Pizza Hut South Korea market we recorded a goodwill

impairment charge of $12 million for this market during 2009. This charge was recorded in Closure and impairment

(income) expenses in our Consolidated Statement of Income and was allocated to our International Division for

performance reporting purposes.

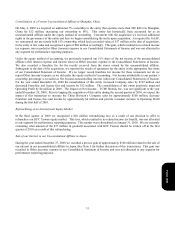

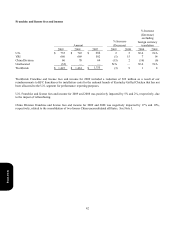

Consolidation of a Former Unconsolidated Affiliate in Beijing, China

In 2008, we began consolidating an entity in which we have a majority ownership interest and that operates the KFCs in

Beijing, China. Our partners in this entity are essentially state-owned enterprises. We historically did not consolidate this

entity, instead accounting for the unconsolidated affiliate using the equity method of accounting, due to the effective

participation of our partners in the significant decisions of the entity that were made in the ordinary course of business.

Concurrent with a decision that we made on January 1, 2008 regarding top management of the entity, we no longer

believe that our partners effectively participate in the decisions that are made in the ordinary course of business. In

accordance with GAAP, we began consolidating this entity on that date.

Like our other unconsolidated affiliates, the accounting for this entity prior to 2008 resulted in royalties being reflected as

Franchise and license fees and our share of the entity’s net income being reflected in Other (income) expense. Subsequent

to the date of consolidation, we reported the results of operations for the entity in the appropriate line items of our

Consolidated Statement of Income. We no longer record franchise fee income for these restaurants nor do we report

Other (income) expense as we did under the equity method of accounting. Net income attributable to our partner’s

ownership percentage is recorded as Net Income-noncontrolling interest within our Consolidated Statement of Income.

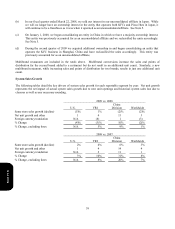

For the year ended December 27, 2008 the consolidation of this entity increased the China Division’s Company sales by

approximately $300 million and decreased Franchise and license fees and income by approximately $20 million. The

consolidation of this entity positively impacted Operating Profit by approximately $20 million in 2008. The positive

impact on Operating Profit was offset by Net Income – noncontrolling interest of $8 million and a higher Income tax

provision such that there was no impact on Net Income – YUM! Brands, Inc. for the year ended December 27, 2008. The

Consolidated Statement of Income was impacted by similar amounts for the year ended December 26, 2009.

Form 10-K