Pizza Hut 2009 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Due to the inherent volatility of actuarially determined property and casualty loss estimates, it is reasonably possible that

we could experience changes in estimated losses which could be material to our growth in quarterly and annual net

income. We believe that we have recorded reserves for property and casualty losses at a level which has substantially

mitigated the potential negative impact of adverse developments and/or volatility.

Legal Proceedings

We are subject to various claims and contingencies related to lawsuits, real estate, environmental and other matters arising

in the normal course of business. We provide reserves for such claims and contingencies when payment is probable and

reasonably estimable.

On November 26, 2001, Kevin Johnson, a former Long John Silver’s (“LJS”) restaurant manager, filed a collective action

against LJS in the United States District Court for the Middle District of Tennessee alleging violation of the Fair Labor

Standards Act (“FLSA”) on behalf of himself and allegedly similarly-situated LJS general and assistant restaurant

managers. Johnson alleged that LJS violated the FLSA by perpetrating a policy and practice of seeking monetary

restitution from LJS employees, including Restaurant General Managers (“RGMs”) and Assistant Restaurant General

Managers (“ARGMs”), when monetary or property losses occurred due to knowing and willful violations of LJS policies

that resulted in losses of company funds or property, and that LJS had thus improperly classified its RGMs and ARGMs

as exempt from overtime pay under the FLSA. Johnson sought overtime pay, liquidated damages, and attorneys’ fees for

himself and his proposed class.

LJS moved the Tennessee district court to compel arbitration of Johnson’s suit. The district court granted LJS’s motion

on June 7, 2004, and the United States Court of Appeals for the Sixth Circuit affirmed on July 5, 2005.

On December 19, 2003, while the arbitrability of Johnson’s claims was being litigated, former LJS managers Erin Cole

and Nick Kaufman, represented by Johnson’s counsel, initiated arbitration with the American Arbitration Association

(“AAA”) (the “Cole Arbitration”). The Cole Claimants sought a collective arbitration on behalf of the same putative class

as alleged in the Johnson lawsuit and alleged the same underlying claims.

On June 15, 2004, the arbitrator in the Cole Arbitration issued a Clause Construction Award, finding that LJS’s Dispute

Resolution Policy did not prohibit Claimants from proceeding on a collective or class basis. LJS moved unsuccessfully to

vacate the Clause Construction Award in federal district court in South Carolina. On September 19, 2005, the arbitrator

issued a Class Determination Award, finding, inter alia, that a class would be certified in the Cole Arbitration on an “opt-

out” basis, rather than as an “opt-in” collective action as specified by the FLSA.

On January 20, 2006, the district court denied LJS’s motion to vacate the Class Determination Award and the United

States Court of Appeals for the Fourth Circuit affirmed the district court’s decision on January 28, 2008. A petition for a

writ of certiorari filed in the United States Supreme Court seeking a review of the Fourth Circuit’s decision was denied on

October 7, 2008. The parties participated in mediation on April 24, 2008, and again on February 28, 2009, without

reaching resolution. Arbitration on liability during a portion of the alleged restitution policy period began in November,

2009 but was delayed at the request of the plaintiffs. The parties again participated in mediation on November 18, 2009

without reaching resolution. Arbitration proceedings are scheduled to resume at the end of May, 2010.

Based on the rulings issued to date in this matter, the Cole Arbitration is proceeding as an “opt-out” class action, rather

than as an “opt-in” collective action. LJS denies liability and is vigorously defending the claims in the Cole Arbitration.

We have provided for a reasonable estimate of the cost of the Cole Arbitration, taking into account a number of factors,

including our current projection of eligible claims, the estimated amount of each eligible claim, the estimated claim

recovery rate, the estimated legal fees incurred by Claimants and a reasonable settlement value of Claimants’ claims.

However, in light of the inherent uncertainties of litigation, the fact-specific nature of Claimants’ claims, and the novelty

of proceeding in an FLSA lawsuit on an “opt-out” basis, there can be no assurance that the Cole Arbitration will not result

in losses in excess of those currently provided for in our Consolidated Financial Statements.

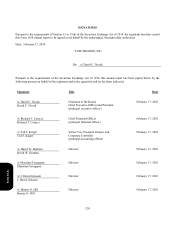

Form 10-K