Pizza Hut 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

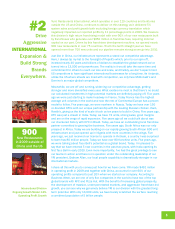

Yum! Restaurants International, which operates in over 110 countries and territories

outside the US and China, continues to deliver on this strategy as it delivered 5%

system sales and prot growth both excluding foreign currency translation which

negatively impacted our reported prots by 11 percentage points in 2009. We treasure

this division’s high return franchising model with over 90% of our new restaurants built

by franchisees who generate over $650 million in franchise fees, requiring minimal

capital on our part. Driven by this franchisee development machine, we opened nearly

900 new restaurants in over 75 countries. That’s the tenth straight year we have

opened more than 700 new units and our pipeline remains strong as we go into 2010.

Just like in China, our infrastructure represents a stand-out competitive advantage.

Here, I always tip my hat to the foresight of PepsiCo which, prior to our spin-off,

invested nearly 40 years and billions of dollars to establish the global network we’ve

turned into a 13,000 unit powerhouse. The reality is it would take the same time and

commitment for others to reach our size and scale, and frankly, we don’t expect most

US competitors to have signicant international businesses for a long time. As it stands,

unlike the US where streets are lined with competition, we only face McDonald’s and

Domino’s as major global competitors.

Meanwhile, we are off and running, widening our competitive advantage, getting

stronger and more diversied every year. What excites me most is that there’s no doubt

our calculated investments in high potential markets are denitely paying off. Five years

ago we were just starting to make headway in France. Today France has the highest

average unit volumes in the world and now the rest of Continental Europe has a proven

model to follow. Five years ago, we were nowhere in Russia. Today we have over 150

co-branded KFCs with our unique partnership with the leading Russian chicken chain,

Rostik’s, giving us the kind of scale it took us ten years to build in China. Five years ago,

KFC was just a dream in India. Today, we have 72 units, strong sales, good margins

and are on the verge of rapid expansion. Five years ago all we could talk about was

our checkered history with KFC in Brazil. Today, we have an outstanding local franchise

partner committed to growing the business. Five years ago, South Africa was our only

prospect in Africa. Today we are building on our rapidly growing South African 600 unit

infrastructure and just opened up in Nigeria with more countries in the wings. Five

years ago, we just received our license to operate in Vietnam, a country I was surprised

to learn has 80 million people. Today we have over 80 franchise units. Five years ago,

we were talking about Taco Bell’s potential as a global brand. Today, I’m pleased to

say that we have entered 5 new countries in the past two years, with India opening its

rst Taco Bell in early 2010. Even more importantly, I’ve had the great privilege to see

our teams in action and there is no question under the outstanding leadership of our

YRI president, Graham Allan, our local people capability is dramatically stronger in our

international markets.

I share all this with you to convey just how far we have come. YRI made $491 million

in operating prot in 2009 and together with China, accounts for over 60% of our

operating prots compared to just 20% when we started our company. According to

Business Week, we are one of only ve companies in the world to have two of the top

global brands with KFC and Pizza Hut. With the benet of increasing global prosperity,

the development of massive, under-penetrated markets, and aggressive franchisee-led

growth, you can see why we genuinely believe YRI is our division with the greatest long-

term potential. With only 13,000 units, we have barely scratched the surface reaching

a combined population of 5 billion people.

#2

Drive

Aggressive

international

Expansion &

Build Strong

Brands

Everywhere.

900

New Restaurants

in 2009 outside of

China and the US

International Division

Ongoing Growth Model: 10%

Operating Prot Growth

5