Pizza Hut 2009 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

Potential awards to employees and non-employee directors under the LTIPs include stock options, incentive stock options,

SARs, restricted stock, stock units, restricted stock units, performance restricted stock units, performance share units and

performance units. Through December 26, 2009, we have issued only stock options, SARs, restricted stock units and

performance share units under the LTIPs. While awards under the LTIPs can have varying vesting provisions and

exercise periods, outstanding awards under the LTIPs vest in periods ranging from immediate to 5 years and expire ten

years after grant.

Potential awards to employees under the RGM Plan include stock options, SARs, restricted stock and restricted stock

units. Through December 26, 2009, we have issued only stock options and SARs under this plan. RGM Plan awards

granted have a four year cliff vesting period and expire ten years after grant. Certain RGM Plan awards are granted upon

attainment of performance conditions in the previous year. Expense for such awards is recognized over a period that

includes the performance condition period.

Potential awards to employees under SharePower include stock options, SARs, restricted stock and restricted stock units.

SharePower awards consist only of stock options and SARs to date, which vest over a period ranging from one to four

years and expire no longer than ten years after grant.

At year end 2009, approximately 24 million shares were available for future share-based compensation grants under the

above plans.

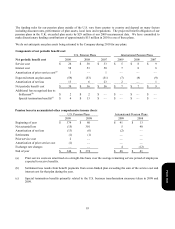

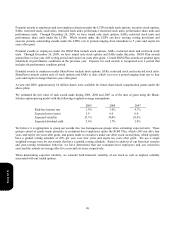

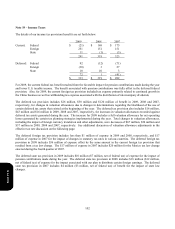

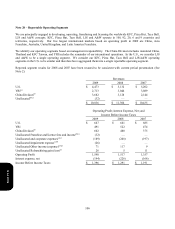

We estimated the fair value of each award made during 2009, 2008 and 2007 as of the date of grant using the Black-

Scholes option-pricing model with the following weighted-average assumptions:

2009 2008 2007

Risk-free interest rate 1.9

%

3.0

%

4.7

%

Expected term (years) 5.9 6.0 6.0

Expected volatility 32.3

%

30.9

%

28.9 %

Expected dividend yield 2.6

%

1.7

%

2.0

%

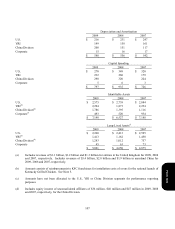

We believe it is appropriate to group our awards into two homogeneous groups when estimating expected term. These

groups consist of grants made primarily to restaurant-level employees under the RGM Plan, which cliff vest after four

years and expire ten years after grant, and grants made to executives under our other stock award plans, which typically

have a graded vesting schedule of 25% per year over four years and expire ten years after grant. We use a single

weighted-average term for our awards that have a graded vesting schedule. Based on analysis of our historical exercise

and post-vesting termination behavior, we have determined that our restaurant-level employees and our executives

exercised the awards on average after five years and six years, respectively.

When determining expected volatility, we consider both historical volatility of our stock as well as implied volatility

associated with our traded options.

Form 10-K