Pizza Hut 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

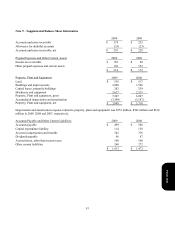

Note 5 – Items Affecting Comparability of Net Income and Cash Flows

U.S. Business Transformation

As part of our plan to transform our U.S. business we took several measures (“the U.S. business transformation

measures”) in 2008 and 2009 including: expansion of our U.S. refranchising; a reduced emphasis on multi-branding as a

long-term growth strategy; G&A productivity initiatives and realignment of resources (primarily severance and early

retirement costs); and investments in our U.S. Brands made on behalf of our franchisees such as equipment purchases.

In the years ended December 26, 2009 and December 27, 2008, we recorded a pre-tax gain of $34 million and a pre-tax

loss of $5 million from refranchising in the U.S., respectively. The 2008 refranchising losses were the net result of, or

offers to refranchise, stores or groups of stores in the U.S. at prices less than their recorded carrying values.

As a result of a decline in future profit expectations for our LJS and A&W businesses in the U.S. due in part to the impact

of a reduced emphasis on multi-branding, we recorded a non-cash charge of $26 million, which resulted in no related tax

benefit, in the fourth quarter of 2009 to write-off the goodwill associated with these businesses. See Note 10.

In connection with our G&A productivity initiatives and realignment of resources we recorded pre-tax charges of $16

million and $49 million in 2009 and 2008, respectively. The unpaid current liability for the severance portion of these

charges was $5 million and $27 million as of December 26, 2009 and December 27, 2008, respectively. Severance

payments in the year ended December 26, 2009 totaled approximately $26 million.

Additionally, the Company recognized a reduction to Franchise and license fees and income of $32 million, pre-tax, in the

year ended December 26, 2009 related to investments in our U.S. Brands. These investments reflect our reimbursements

to KFC franchisees for installation costs of ovens for the national launch of Kentucky Grilled Chicken. The

reimbursements were recorded as a reduction to franchise and license fees and income as we would not have provided the

reimbursements absent the ongoing franchise relationship. In the year ended December 27, 2008, the Company

recognized pre-tax expense of $7 million related to investments in our U.S. Brands in Franchise and license expenses.

We are not including the impacts of these U.S. business transformation measures in our U.S. segment for performance

reporting purposes as we do not believe they are indicative of our ongoing operations.

Form 10-K