Pizza Hut 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032

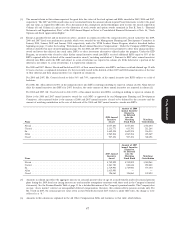

to our security department and that incremental cost is reflected in the ‘‘Other’’ column of the All Other

Compensation Table.

In the case of Mr. Su, he receives several perquisites related to his overseas assignment. These

perquisites were part of his original compensation package and the Committee has elected to continue to

provide them. The amount of these perquisites is reported on page 48. Mr. Su’s agreement provides that

the following will be provided: annual foreign service premium; local social club dues; car; housing,

commodities, and utilities allowances; tax preparation services, tax equalization to the United States for

salary and bonus; and tax equalization to Hong Kong (up to a maximum of $5 million) with respect to

income attributable to certain stock option and SAR exercises and to distributions of deferred income.

When Mr. Su retires from the Company, he will be required to reimburse the Company for the tax

reimbursements for certain stock option and SARs exercises, if any, made within six months of his

retirement.

Review of Total Compensation

We intend to continue our strategy of compensating our executives through programs that emphasize

performance-based compensation. To that end, executive compensation through annual incentives and

stock appreciation rights/stock option grants is tied directly to our performance and is structured to ensure

that there is an appropriate balance between our financial performance and shareholder return. The

Committee reviewed each element of compensation and believes that the compensation was reasonable in

its totality. In addition, the Committee believes that various elements of this program effectively achieve

the objective of aligning compensation with performance measures that are directly related to the

Company’s financial goals and creation of shareholder value without encouraging executives to take

unnecessary and excessive risks.

Before finalizing compensation actions, the Committee took into consideration all elements of

compensation accruing to each NEO in 2009. These elements included salary, annual incentive award,

long-term incentive awards, value of outstanding equity awards (vested and unvested), and lump sum value

of pension at retirement and gains realized from exercising stock options. The Committee will continue to

review total compensation at least once a year.

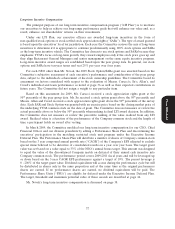

YUM’s Executive Stock Ownership Guidelines

Proxy Statement

The Committee has established stock ownership guidelines for our top 600 employees. Our Chief

Executive Officer is required to own 336,000 shares of YUM stock or stock equivalents (approximately

eight times his base salary). Executive officers (other than Mr. Novak) are expected to attain their

ownership targets, equivalent in value to two to three times their current annual base salary depending

upon their positions, within five years from the time the established targets become applicable. If an

executive does not meet his or her ownership guideline, he or she is not eligible for a grant under the LTI

Plan. In 2009, all executive officers and all other employees subject to guidelines met or exceeded their

ownership guidelines.

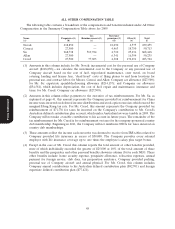

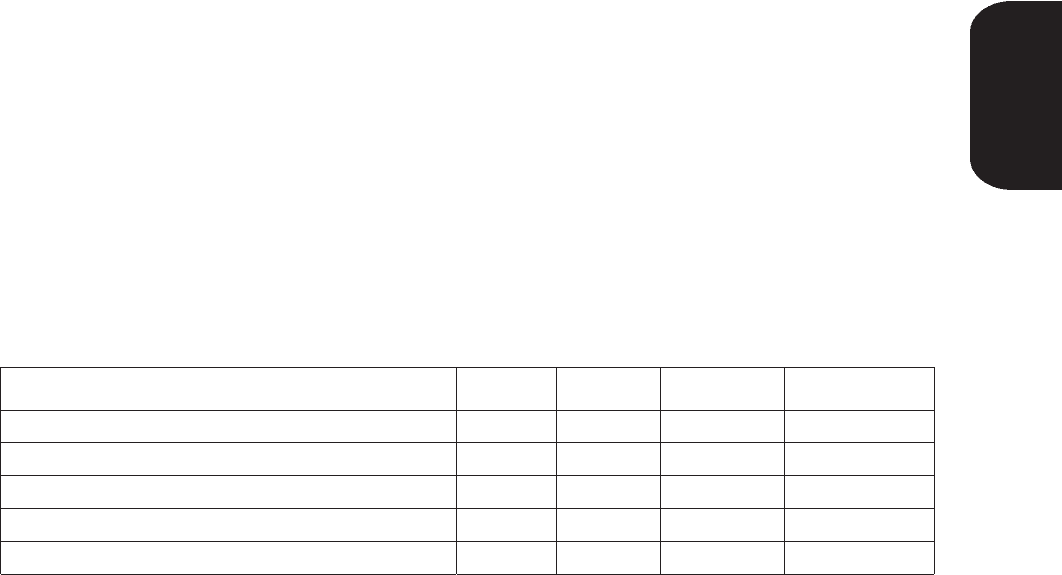

Ownership Shares Value of Shares Owned as

Guidelines Owned(1) Shares(2) Multiple of Salary

Novak 336,000 2,354,836 $82,348,615 59

Carucci 50,000 147,950 $ 5,173,812 7

Allan 50,000 597,738 $20,902,898 26

Su 50,000 401,634 $14,045,141 17

Creed 50,000 109,393 $ 3,825,473 6

(1) Calculated as of December 31, 2009 and represents shares owned outright by the NEO and RSUs

acquired under the Company’s executive income deferral program.

(2) Based on YUM closing stock price of $34.97 as of December 31, 2009.

Under our Code of Conduct, speculative trading in YUM stock, including trading in puts, calls or

other hedging or monetization transactions, is prohibited.

41