Pizza Hut 2009 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

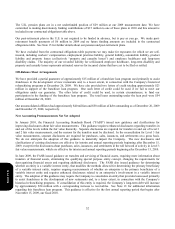

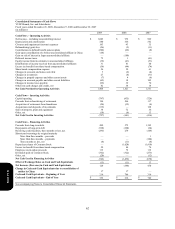

62

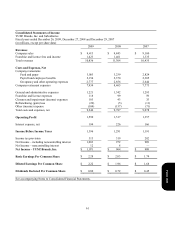

Consolidated Statements of Cash Flows

YUM! Brands, Inc. and Subsidiaries

Fiscal years ended December 26, 2009, December 27, 2008 and December 29, 2007

(in millions)

2009 2008 2007

Cash Flows – Operating Activities

N

et Income – including noncontrolling interest $ 1,083 $ 972 $ 909

Depreciation and amortization 580 556 542

Closures and impairment (income) expenses 103 43 35

Refranchising (gain) loss (26 ) (5 ) (11 )

Contributions to defined benefit pension plans (280 ) (66 ) (8 )

Gain upon consolidation of a former unconsolidated affiliate in China (68 ) —

—

Gain on sale of interest in Japan unconsolidated affiliate — (100 )

—

Deferred income taxes 72 1 (41 )

Equity income from investments in unconsolidated affiliates (36 ) (41 ) (51 )

Distributions of income received from unconsolidated affiliates 31 41 40

Excess tax benefit from share-based compensation (59 ) (44 ) (74 )

Share-based compensation expense 56 59 61

Changes in accounts and notes receivable 3 (6 ) (4 )

Changes in inventories 27 (8 ) (31 )

Changes in prepaid expenses and other current assets (7 ) 4 (6 )

Changes in accounts payable and other current liabilities (62 ) 18 102

Changes in income taxes payable (95 ) 39 70

Other non-cash charges and credits, net 82 58 18

Net Cash Provided by Operating Activities 1,404 1,521 1,551

Cash Flows – Investing Activities

Capital spending (797 ) (935 ) (726 )

Proceeds from refranchising of restaurants 194 266 117

Acquisition of restaurants from franchisees (24 ) (35 ) (4 )

Acquisitions and disposals of investments (115 ) — 128

Sales of property, plant and equipment 34 72 56

Other, net (19 ) (9 ) 13

Net Cash Used in Investing Activities (727 ) (641 ) (416 )

Cash Flows – Financing Activities

Proceeds from long-term debt 499 375 1,195

Repayments of long-term debt (528 ) (268 ) (24 )

Revolving credit facilities, three months or less, net (295 ) 279 (149 )

Short-term borrowings by original maturity

More than three months – proceeds — — 1

More than three months – payments — — (184 )

Three months or less, net (8 ) (11 ) (8 )

Repurchase shares of Common Stock — (1,628 ) (1,410 )

Excess tax benefit from share-based compensation 59 44 74

Employee stock option proceeds 113 72 112

Dividends paid on Common Stock (362 ) (322 ) (273 )

Other, net (20 ) — (12 )

Net Cash Used in Financing Activities (542 ) (1,459 ) (678 )

Effect of Exchange Rates on Cash and Cash Equivalents (15 ) (11 ) 13

Net Increase (Decrease) in Cash and Cash Equivalents 120 (590 ) 470

Change in Cash and Cash Equivalents due to consolidation of

entities in China

17 17 —

Cash and Cash Equivalents – Beginning of Year 216 789 319

Cash and Cash Equivalents – End of Year $ 353 $ 216 $ 789

See accompanying Notes to Consolidated Financial Statements.

Form 10-K