Pizza Hut 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032309

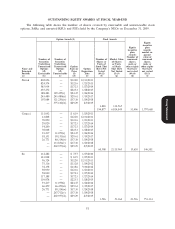

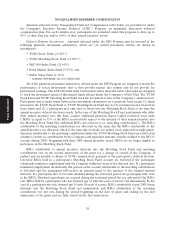

ALL OTHER COMPENSATION TABLE

The following table contains a breakdown of the compensation and benefits included under All Other

Compensation in the Summary Compensation Table above for 2009.

Tax Insurance

Name Perquisites(1) Reimbursements(2) premiums(3) Other(4) Total

(a) (b) (c) (d) (e) (f)

Novak 218,850 — 18,030 2,575 239,455

Carucci 27,500 — 4,463 18,750 50,713

Su 268,738 569,784 4,710 25,236 868,468

Allan 27,500 — 6,341 16,394 50,235

Creed 27,500 77,605 4,308 174,291 283,704

(1) Amounts in this column include for Mr. Novak: incremental cost for the personal use of Company

aircraft ($218,850);—we calculate the incremental cost to the Company of any personal use of

Company aircraft based on the cost of fuel, trip-related maintenance, crew travel, on board

catering, landing and license fees, ‘‘dead head’’ costs of flying planes to and from locations for

personal use, and contract labor; for Messrs. Carucci and Allan: Company car allowance ($27,500);

for Mr. Su: expatriate spendables/housing allowance ($214,157); and Company car allowance

($54,581), which includes depreciation, the cost of fuel, repair and maintenance, insurance and

taxes; for Mr. Creed: Company car allowance ($27,500).

(2) Amounts in this column reflect payments to the executive of tax reimbursements. For Mr. Su, as

explained at page 41, this amount represents the Company provided tax reimbursement for China

income taxes incurred on deferred income distributions and stock option exercises which exceed the

marginal Hong Kong tax rate. For Mr. Creed, this amount represents the Company provided tax

reimbursement of $71,736 for taxes he incurred on the Company’s contribution to Mr. Creed’s

Australian defined contribution plan account, which under Australian law were taxable in 2009. The

Company will not make a taxable contribution to his account in future years. The remainder of the

tax reimbursement for Mr. Creed is for reimbursement on taxes for his company sponsored country

Proxy Statement

club membership. Beginning in 2011, the Company will not reimburse NEOs for taxes incurred on

country club memberships.

(3) These amounts reflect the income each executive was deemed to receive from IRS tables related to

Company provided life insurance in excess of $50,000. The Company provides every salaried

employee with life insurance coverage up to one times the employee’s salary plus target bonus.

(4) Except in the case of Mr. Creed, this column reports the total amount of other benefits provided,

none of which individually exceeded the greater of $25,000 or 10% of the total amount of these

benefits and the perquisites and other personal benefits shown in column (b) for each NEO. These

other benefits include: home security expense, perquisite allowance, relocation expenses, annual

payment for foreign service, club dues, tax preparation assistance, Company provided parking,

personal use of Company aircraft and annual physical. For Mr. Creed, this column includes

Company annual contributions to his Australian defined contribution plan ($82,701) and foreign

expatriate defined contribution plan ($77,421).

48