Pizza Hut 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

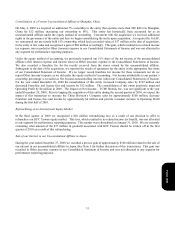

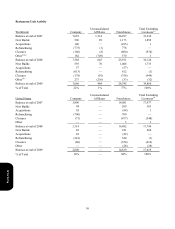

Consolidation of a Former Unconsolidated Affiliate in Shanghai, China

On May 4, 2009 we acquired an additional 7% ownership in the entity that operates more than 200 KFCs in Shanghai,

China for $12 million, increasing our ownership to 58%. This entity has historically been accounted for as an

unconsolidated affiliate under the equity method of accounting. Concurrent with the acquisition we received additional

rights in the governance of the entity and thus we began consolidating the entity upon acquisition. As required by GAAP,

we remeasured our previously held 51% ownership, which had a recorded value of $17 million at the date of acquisition,

in the entity at fair value and recognized a gain of $68 million accordingly. This gain, which resulted in no related income

tax expense, was recorded in Other (income) expense in our Consolidated Statements of Income and was not allocated to

any segment for performance reporting purposes.

Under the equity method of accounting, we previously reported our 51% share of the net income of the unconsolidated

affiliate (after interest expense and income taxes) as Other (income) expense in the Consolidated Statements of Income.

We also recorded a franchise fee for the royalty received from the stores owned by the unconsolidated affiliate.

Subsequent to the date of the acquisition, we reported the results of operations for the entity in the appropriate line items

of our Consolidated Statement of Income. We no longer record franchise fee income for these restaurants nor do we

report Other (income) expense as we did under the equity method of accounting. Net income attributable to our partner’s

ownership percentage is recorded as Net Income-noncontrolling interest within our Consolidated Statements of Income.

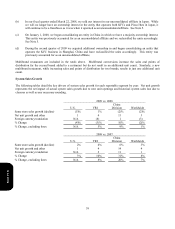

For the year ended December 26, 2009 the consolidation of this entity increased Company sales by $192 million and

decreased Franchise and license fees and income by $12 million. The consolidation of this entity positively impacted

Operating Profit by $4 million in 2009. The impact on Net Income – YUM! Brands, Inc. was not significant to the year

ended December 26, 2009. Prior to lapping the acquisition of this entity during the second quarter of 2010, we expect the

impact of this transaction to increase the China Division’s Company sales by approximately $100 million, decrease

Franchise and license fees and income by approximately $6 million and provide a modest increase to Operating Profit

during the first half of 2010.

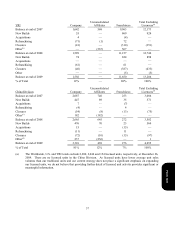

Refranchising of an International Equity Market

In the third quarter of 2009 we recognized a $10 million refranchising loss as a result of our decision to offer to

refranchise our KFC Taiwan equity market. This loss, which resulted in no related income tax benefit, was not allocated

to any segment for performance reporting purposes. This market was refranchised on January 31, 2010. We are currently

evaluating what amount of the $37 million in goodwill associated with KFC Taiwan should be written off in the first

quarter of 2010 as a result of this refranchising.

Sale of our Interest in our Unconsolidated Affiliate in Japan

During the year ended December 27, 2008 we recorded a pre-tax gain of approximately $100 million related to the sale of

our interest in our unconsolidated affiliate in Japan (See Note 5 for further discussion of this transaction). This gain was

recorded in Other (income) expense in our Consolidated Statement of Income and was not allocated to any segment for

performance reporting purposes.

Form 10-K