Pizza Hut 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

38

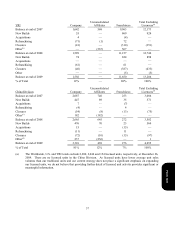

(b) In our fiscal quarter ended March 22, 2008, we sold our interest in our unconsolidated affiliate in Japan. While

we will no longer have an ownership interest in the entity that operates both KFCs and Pizza Huts in Japan, it

will continue to be a franchisee as it was when it operated as an unconsolidated affiliate. See Note 5.

(c) On January 1, 2008, we began consolidating an entity in China in which we have a majority ownership interest.

This entity was previously accounted for as an unconsolidated affiliate and we reclassified the units accordingly.

See Note 5.

(d) During the second quarter of 2009 we acquired additional ownership in and began consolidating an entity that

operates the KFC business in Shanghai, China and have reclassified the units accordingly. This entity was

p

reviously accounted for as an unconsolidated affiliate.

Multibrand restaurants are included in the totals above. Multibrand conversions increase the sales and points of

distribution for the second brand added to a restaurant but do not result in an additional unit count. Similarly, a new

multibrand restaurant, while increasing sales and points of distribution for two brands, results in just one additional unit

count.

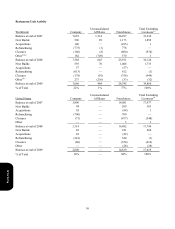

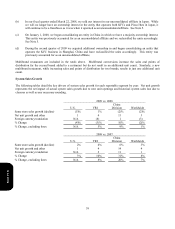

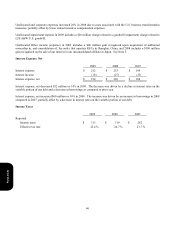

System Sales Growth

The following tables detail the key drivers of system sales growth for each reportable segment by year. Net unit growth

represents the net impact of actual system sales growth due to new unit openings and historical system sales lost due to

closures as well as any necessary rounding.

2009 vs. 2008

U.S. YRI

China

Division Worldwide

Same store sales growth (decline) (5) % 1% (2) % (2)%

N

et unit growth and other 1 4 11 3

Foreign currency translation N/A (8) 1 (3)

% Change (4) % (3)% 10 % (2)%

% Change, excluding forex N/A 5% 9 % 1%

2008 vs. 2007

U.S. YRI

China

Division Worldwide

Same store sales growth (decline) 2% 4% 6 % 3%

N

et unit growth and other 1 4 14 4

Foreign currency translation N/A 2 11 1

% Change 3% 10% 31 % 8%

% Change, excluding forex N/A 8% 20 % 7%

Form 10-K