Pizza Hut 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

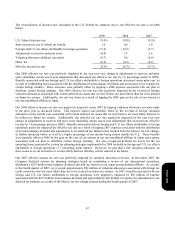

The U.K. pension plans are in a net underfunded position of $29 million at our 2009 measurement date. We have

committed to making discretionary funding contributions of $15 million to one of these plans in 2010 and this amount is

included in our contractual obligations table above.

Our post-retirement plan in the U.S. is not required to be funded in advance, but is pay as you go. We made post-

retirement benefit payments of $6 million in 2009 and no future funding amounts are included in the contractual

obligations table. See Note 15 for further details about our pension and post-retirement plans.

We have excluded from the contractual obligations table payments we may make for exposures for which we are self-

insured, including workers’ compensation, employment practices liability, general liability, automobile liability, product

liability and property losses (collectively “property and casualty losses”) and employee healthcare and long-term

disability claims. The majority of our recorded liability for self-insured employee healthcare, long-term disability and

property and casualty losses represents estimated reserves for incurred claims that have yet to be filed or settled.

Off-Balance Sheet Arrangements

We have provided a partial guarantee of approximately $15 million of a franchisee loan program used primarily to assist

franchisees in the development of new restaurants and, to a lesser extent, in connection with the Company’s historical

refranchising programs at December 26, 2009. We have also provided two letters of credit totaling approximately $23

million in support of the franchisee loan program. One such letter of credit could be used if we fail to meet our

obligations under our guarantee. The other letter of credit could be used, in certain circumstances, to fund our

participation in the funding of the franchisee loan program. The total loans outstanding under the loan pool were $54

million at December 26, 2009.

Our unconsolidated affiliates had approximately $40 million and $50 million of debt outstanding as of December 26, 2009

and December 27, 2008, respectively.

New Accounting Pronouncements Not Yet Adopted

In January 2010, the Financial Accounting Standards Board (“FASB”) issued new guidance and clarifications for

improving disclosures about fair value measurements. This guidance requires enhanced disclosures regarding transfers in

and out of the levels within the fair value hierarchy. Separate disclosures are required for transfers in and out of Level 1

and 2 fair value measurements, and the reasons for the transfers must be disclosed. In the reconciliation for Level 3 fair

value measurements, separate disclosures are required for purchases, sales, issuances, and settlements on a gross basis.

We do not anticipate the adoption of this guidance to materially impact the Company. The new disclosures and

clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15,

2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3

fair value measurements, which are effective for interim and annual reporting periods beginning after December 15, 2010.

In June 2009, the FASB issued guidance on transfers and servicing of financial assets, requiring more information about

transfers of financial assets, eliminating the qualifying special purpose entity concept, changing the requirements for

derecognizing financial assets and requiring additional disclosures. The FASB also issued guidance for determining

whether an entity is a variable interest entity, that modifies the methods allowed for determining the primary beneficiary

of a variable interest entity, requires ongoing reassessments of whether an enterprise is the primary beneficiary of a

variable interest entity and requires enhanced disclosures related to an enterprise’s involvement in a variable interest

entity. The adoption of this guidance may require the Company to consolidate an entity that provides loans used primarily

to assist franchisees in the development of new restaurants and, to a lesser extent, in connection with the Company’s

historical refranchising programs. If consolidation of this entity is required, the Company’s long-term debt will increase

by approximately $54 million with a corresponding increase to receivables. See Note 21 for additional information

regarding this franchisee loan program. This guidance is effective for the first annual reporting period that begins after

November 15, 2009, our fiscal 2010.

Form 10-K