Pizza Hut 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032309

at that time) for this peer group was $16.1 billion. Data for each individual job was regressed based on the

estimated revenue size of the division that the NEO was responsible for in 2008, specifically $16.3 billion

for Messrs. Novak and Carucci, $5.3 billion for Mr. Allan, and $3.1 billion for Mr. Su and Mr. Creed.

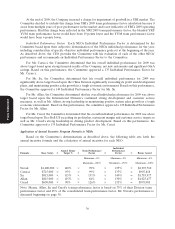

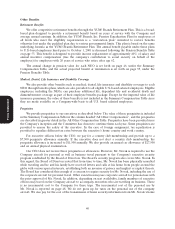

Companies included in the Peer Group

For the benchmarking done in late 2008, the peer group for all NEOs was made up of nondurable

consumer product companies. The Committee established this peer group for the CEO and other NEO’s

compensation in 2008. Periodically the Committee, with Hewitt’s assistance, reviews the composition of the

peer group to ensure the companies are relevant for comparative purposes. The Committee added six

companies and deleted ten companies for 2009. We believe this reconstituted group of companies is

reflective of nondurable consumer goods sector in which we operate. The group was chosen because each

of the company’s relative leadership position in their sector, relative size as measured by revenues, relative

complexity of the business, and in some cases because of their global reach. The companies deleted from

the survey group represented companies whose data was not as readily available, had been acquired or

because of acquisitions were no longer a good match for the group. The companies comprising this

nondurable consumer products group used for the benchmarking done at the end of 2008 were:

2007 Sales/ 2007 Sales/

Revenues Revenues

Company Name ($billions) Company Name ($billions)

Lowe’s Companies, Inc. ........... 48.3 Colgate-Palmolive Company ........ 13.8

Walgreen Co. .................. 44.8 Marriott International, Inc. ........ 13.0

PepsiCo, Inc. .................. 39.5 General Mills, Inc. .............. 12.4

Kraft Foods, Inc. ............... 37.2 Kellogg Company ............... 11.8

The Coca-Cola Company .......... 28.9 Avon Products, Inc. ............. 9.9

Macy’s, Inc. ................... 26.3 Dollar General Corporation ........ 9.2

McDonald’s Corporation .......... 22.8 OfficeMax Incorporated ........... 9.1

J. C. Penney Company, Inc. ........ 19.9 Campbell Soup Company .......... 7.9

Staples, Inc. ................... 19.4 AutoZone, Inc. ................. 6.2

Starwood Hotels & Resorts

Proxy Statement

Kimberly-Clark Corporation ........ 18.3 Worldwide, Inc. ............... 6.2

Anheuser-Busch Companies, Inc. .... 16.7 Mattel Corporation .............. 6.0

Kohl’s Corporation .............. 16.5 Darden Restaurants, Inc. .......... 5.6

The Gap, Inc. .................. 15.8 The Hershey Company ........... 4.9

Mars, Incorporated .............. (1)

Median ....................... 16.1

YUM(2) ...................... 16.3

(1) Data Not Publicly Available

(2) Projected 2008 company sales + 25% of franchisee and licensee sales

Targeting Compensation

For the NEOs, other than our CEO, we target the elements of our compensation program as follows:

• Base salary—because NEOs are expected to make significant contributions in current and future

positions and would be considered a critical loss if they left the Company, we target the

75th percentile for base salary

• Performance-based annual incentive compensation—75th percentile to emphasize superior pay for

superior performance

32