Pizza Hut 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

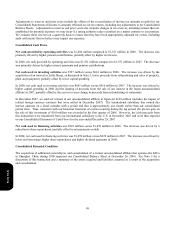

Impairment of Goodwill

We evaluate goodwill for impairment on an annual basis or more often if an event occurs or circumstances change that

indicates impairment might exist. Goodwill is evaluated for impairment through the comparison of fair value of our

reporting units to their carrying values. Our reporting units are our operating segments in the U.S. and our business units

internationally (typically individual countries). Fair value is the price a willing buyer would pay for the reporting unit,

and is generally estimated using discounted expected future after-tax cash flows from company operations and franchise

royalties.

Future cash flow estimates and the discount rate are the key assumptions when estimating the fair value of a reporting

unit. Future cash flows are based on growth expectations relative to recent historical performance and incorporate sales

growth and margin improvement assumptions that we believe a buyer would assume when determining a purchase price

for the reporting unit. The assumptions that factor into the discounted cash flows are highly correlated as cash flow

growth can be achieved through various interrelated strategies such as product pricing and restaurant productivity

initiatives. The discount rate is our estimate of the required rate of return that a third-party buyer would expect to receive

when purchasing a business from us that constitutes a reporting unit. We believe the discount rate is commensurate with

the risks and uncertainty inherent in the forecasted cash flows.

Except for the LJS/A&W-U.S. and Pizza Hut South Korea reporting units discussed below, the fair value of each of our

other reporting units was substantially in excess of its respective carrying value as of the 2009 goodwill impairment test

that was performed at the beginning of the fourth quarter. YUM recorded goodwill impairment charges of $26 million

and $12 million for our LJS/A&W-U.S. and Pizza Hut South Korea reporting units, respectively, as the carrying value of

these reporting units exceeded their fair values. The fair value of the LJS/A&W-U.S. reporting unit was based on our

discounted expected after-tax cash flows from the future royalty stream, net of G&A, expected to be earned from the

underlying franchise agreements. These cash flows incorporated a decline in future profit expectations for our LJS/A&W-

U.S. reporting unit, which were due in part to the impact of a reduced emphasis on multi-branding as a long-term U.S.

growth strategy. The fair value of the Pizza Hut South Korea reporting unit was based on the discounted expected after-

tax future cash flows from company operations and franchise royalties for this reporting unit. Our expectations of after-

tax cash flows for this business were negatively impacted by recent profit declines for this reporting unit.

See Note 2 for a further discussion of our policies regarding goodwill.

Form 10-K