Pizza Hut 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032

Vesting

A participant receives a year of vesting service for each year of employment with the Company. A

participant is 0% vested until he has been credited with at least 5 years of vesting service. Upon attaining

5 years of vesting service, a participant becomes 100% vested. All the NEOs are vested.

Normal Retirement Eligibility

A participant is eligible for Normal Retirement following the later of age 65 or 5 years of vesting

service.

Early Retirement Eligibility and Reductions

A participant is eligible for Early Retirement upon reaching age 55 with 10 years of vesting service. A

participant who has met the requirements for Early Retirement and who elects to begin receiving payments

from the plan prior to age 62 will receive a reduction of 1⁄12 of 4% for each month benefits begin before age

62. Benefits are unreduced at age 62.

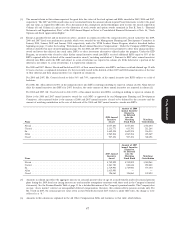

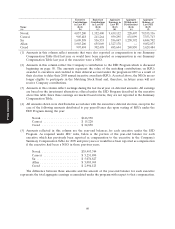

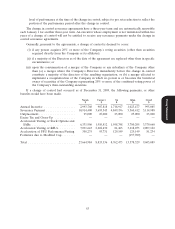

The table below shows when each of the NEOs will be eligible or became eligible for Early

Retirement and the estimated lump sum value of the benefit each participant would receive from the

YUM plans (both qualified and non-qualified) if he retired from the Company at that time and received a

lump sum payment (except however, in the case of Messrs. Novak and Su, who are already Early

Retirement eligible, the estimated lump sum is calculated as if they retired on December 31, 2009).

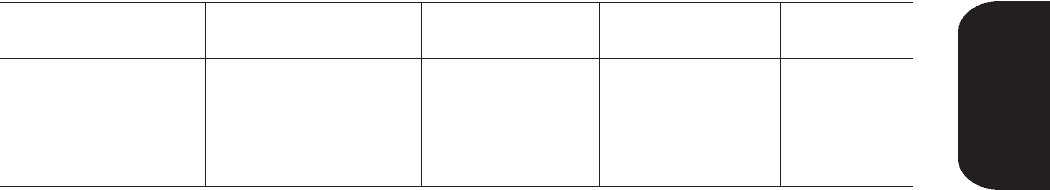

Earliest Estimated Lump Sum Estimated Lump Sum Total

Retirement from the from the Estimated

Name Date Qualified Plan(1) Non-Qualified Plan(2) Lump Sum

David C. Novak November 1, 2007 $1,057,601 $22,892,898 $23,950,499

Rick Carucci July 1, 2012 $ 975,292 $ 5,636,523 $ 6,611,815

Sam Su May 1, 2007 $ — $ 8,103,148 $ 8,103,148

Graham Allan May 1, 2010 $ 447,099 $ 3,261,280 $ 3,708,379

Greg Creed August 1, 2012 $ 143,277 $ — $ 143,277

Proxy Statement

(1) The YUM! Brands Retirement Plan

(2) Mr. Su’s benefit is paid solely from the YUM! Brands International Retirement Plan. All other

non-qualified benefits are paid from the YUM! Brands Inc. Pension Equalization Plan.

The estimated lump sum values in the table above are calculated assuming no increase in the

participant’s Final Average Earnings. The lump sums are estimated using the mortality table and interest

assumption as used for purposes of financial accounting. Actual lump sums may be higher or lower

depending on the mortality table and interest rate in effect at the time of distribution and the participant’s

Final Average Earnings at his date of retirement.

Termination of Employment Prior to Retirement

If a participant terminates employment, either voluntarily or involuntarily, prior to meeting eligibility

for Early or Normal Retirement, benefits will be actuarially reduced from age 65 to his early

commencement date using the mortality rates in the YUM! Brands Retirement Plan and an interest rate

equal to 7% (e.g., this results in a 62.97% reduction at age 55). In addition, the participant may NOT elect

to receive his benefit in the form of a lump sum.

55