Pizza Hut 2009 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

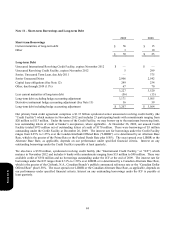

Note 13 – Derivative Instruments

The Company is exposed to certain market risks relating to its ongoing business operations. The primary market risks

managed by using derivative instruments are interest rate risk and cash flow volatility arising from foreign currency

fluctuations.

We enter into interest rate swaps with the objective of reducing our exposure to interest rate risk and lowering interest

expense for a portion of our fixed-rate debt. At December 26, 2009, our interest rate derivative instruments have an

outstanding notional amount of $775 million and have been designated as fair value hedges of a portion of our debt. The

critical terms of these swaps, including reset dates and floating rate indices match those of our underlying fixed-rate debt

and no ineffectiveness has been recorded.

We enter into foreign currency forward contracts with the objective of reducing our exposure to cash flow volatility

arising from foreign currency fluctuations associated with certain foreign currency denominated intercompany short-term

receivables and payables. The notional amount, maturity date, and currency of these contracts match those of the

underlying receivables or payables. For those foreign currency exchange forward contracts that we have designated as

cash flow hedges, we measure ineffectiveness by comparing the cumulative change in the forward contract with the

cumulative change in the hedged item. At December 26, 2009, foreign currency forward contracts outstanding had a total

notional amount of $687 million.

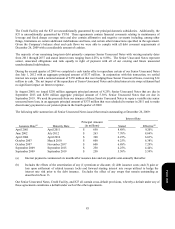

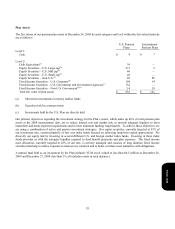

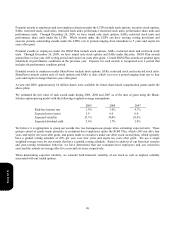

The fair values of derivatives designated as hedging instruments for the year ended December 26, 2009 were:

Fair Value Consolidated Balance Sheet Location

Interest Rate Swaps $ 44 Other assets

Foreign Currency Forwards – Asset 6 Prepaid expenses and other current assets

Foreign Currency Forwards – Liability (3) Accounts payable and other current liabilities

Total $ 47

The unrealized gains associated with our interest rate swaps that hedge the interest rate risk for a portion of our debt have

been reported as an addition of $36 million to long-term debt at December 26, 2009. During the year ended December 26,

2009, Interest expense, net was reduced by $31 million, for recognized gains on these interest rate swaps, including $13

million related to the settlement of interest rate swaps that were hedging the 2012 Senior Unsecured Notes that were

extinguished (See Note 11).

For our foreign currency forward contracts the following effective portions of gains and losses were recognized into Other

Comprehensive Income (“OCI”) and reclassified into income from OCI in the year ended December 26, 2009.

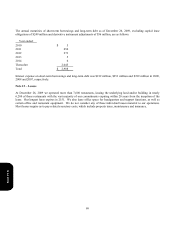

2009

Gains (losses) recognized into OCI, net of tax

$

(4)

Gains (losses) reclassified from Accumulated OCI into income, net of tax

$

(9)

The gains/losses reclassified from Accumulated OCI into income were recognized as Other income (expense) in our

Consolidated Statement of Income, largely offsetting foreign currency transaction losses/gains recorded when the related

intercompany receivables and payables were adjusted for foreign currency fluctuations. Changes in fair values of the

foreign currency forwards recognized directly in our results of operations either from ineffectiveness or exclusion from

effectiveness testing were insignificant in the year ended December 26, 2009.

Form 10-K