Pizza Hut 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

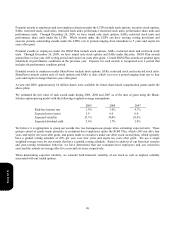

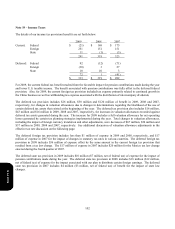

Note 19 – Income Taxes

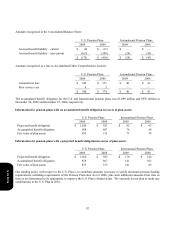

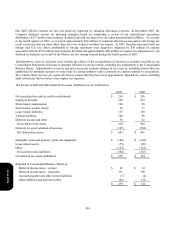

The details of our income tax provision (benefit) are set forth below:

2009 2008 2007

Current: Federal

$

(

21

)

$ 168 $ 175

Forei

g

n 251 151 151

State 11

(

1

)

(

3

)

241 318 323

Deferred: Federal 92

(

12

)

(

71

)

Forei

g

n

(

30

)

3 27

State 10 10 3

72 1

(

41

)

$

313 $ 319 $ 282

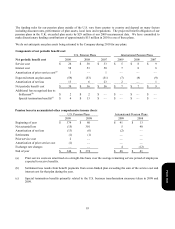

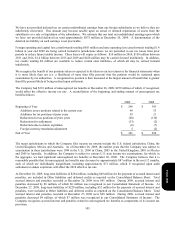

For 2009, the current federal tax benefit resulted from the favorable impact for pension contributions made during the year

and lower U.S. taxable income. The benefit associated with pension contributions was fully offset in the deferred federal

provision. Also, for 2009, the current foreign tax provision included tax expense primarily related to continued growth in

the China business as well as withholding tax expense associated with the distribution of intercompany dividends.

The deferred tax provision includes $26 million, $30 million and $120 million of benefit in 2009, 2008 and 2007,

respectively, for changes in valuation allowances due to changes in determinations regarding the likelihood of the use of

certain deferred tax assets that existed at the beginning of the year. The deferred tax provision also includes $16 million,

$43 million and $16 million in 2009, 2008 and 2007, respectively, for increases in valuation allowances recorded against

deferred tax assets generated during the year. The increase for 2008 includes a full valuation allowance for net operating

losses generated by certain tax planning strategies implemented during the year. Total changes in valuation allowances,

including the impact of foreign currency translation and other adjustments, were decreases of $67 million, $54 million and

$37 million in 2009, 2008 and 2007, respectively. See additional discussion of valuation allowance adjustments in the

effective tax rate discussion on the following page.

The deferred foreign tax provision includes less than $1 million of expense in 2009 and 2008, respectively, and $17

million of expense in 2007 for the impact of changes in statutory tax rates in various countries. The deferred foreign tax

provision in 2008 includes $36 million of expense offset by the same amount in the current foreign tax provision that

resulted from a tax law change. The $17 million of expense in 2007 includes $20 million for the Mexico tax law change

enacted during the fourth quarter of 2007.

The deferred state tax provision in 2009 includes $10 million ($7 million, net of federal tax) of expense for the impact of

pension contributions made during the year. The deferred state tax provision in 2008 includes $18 million ($12 million,

net of federal tax) of expense for the impact associated with our plan to distribute certain foreign earnings. The deferred

state tax provision in 2007 includes $4 million ($3 million, net of federal tax) of benefit for the impact of state law

changes.

Form 10-K