Pizza Hut 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

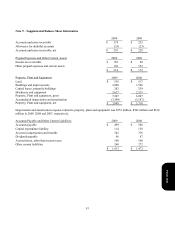

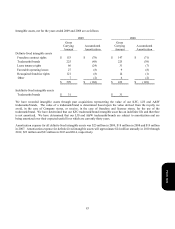

Note 10 – Goodwill and Intangible Assets

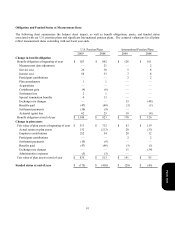

The changes in the carrying amount of goodwill are as follows:

U.S. YRI

China

Division Worldwide

Balance as of December 29, 2007

Goodwill, gross $ 358 $ 259 $ 60 $ 677

Accumulated impairment losses

—

(5

)

—

(5

)

Goodwill, net 358 254 60 672

Acquisitions 10

—

6 16

Impairment losses

—

—

—

—

Disposals and other, net(a) (12) (71

)

—

(83

)

Balance as of December 27, 2008

Goodwill, gross 356 188 66 610

Accumulated impairment losses

—

(5

)

— (5

)

Goodwill, net 356 183

66 605

Acquisitions 1

—

53 54

Impairment losses(b)(c) (26)

(12 )

—

(38

)

Disposals and other, net(a) (5)

24

—

19

Balance as of December 26, 2009

Goodwill, gross 352 212 119 683

Accumulated impairment losses (26) (17 )

—

(43

)

Goodwill, net

$

326

$

195

$

119

$

640

(a) Disposals and other, net for YRI primarily reflects the impact of foreign currency translation on existing

balances. Disposals and other, net for the U.S. Division, primarily reflects goodwill write-offs associated with

refranchising.

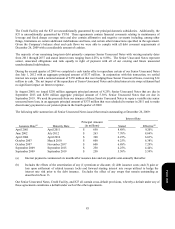

(b) We recorded a non-cash goodwill impairment charge of $26 million, which resulted in no related tax benefit,

associated with our LJS and A&W-U.S. reporting unit in the fourth quarter of 2009 as the carrying value of this

reporting unit exceeded its fair value. The fair value of the reporting unit was based on our discounted

expected after-tax cash flows from the future royalty stream, net of G&A, expected to be earned from the

underlying franchise agreements. These cash flows incorporated the decline in future profit expectations for

our LJS and A&W-U.S. reporting unit which were due in part to the impact of a reduced emphasis on multi-

branding as a U.S. growth strategy. This charge was recorded in Closure and impairment (income) expenses in

our Consolidated Statement of Income and was not allocated to the U.S. segment for performance reporting

purposes. See Note 5.

(c) We recorded a non-cash goodwill impairment charge of $12 million for our Pizza Hut South Korea reporting

unit in the fourth quarter of 2009 as the carrying value of this reporting unit exceeded its fair value. The fair

value of this reporting unit was based on the discounted expected after-tax cash flows from company operations

and franchise royalties for the business. Our expectations of future cash flows were negatively impacted by

recent profit declines the business has experienced. This charge was recorded in Closure and impairment

(income) expenses in our Consolidated Statement of Income and was allocated to our International segment for

performance reporting purposes.

Form 10-K