Pizza Hut 2009 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

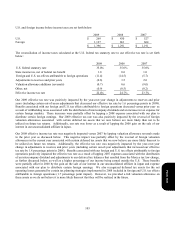

Our 2007 effective income tax rate was positively impacted by valuation allowance reversals. In December 2007, the

Company finalized various tax planning strategies based on completing a review of our international operations,

distributed a $275 million intercompany dividend and sold our interest in our Japan unconsolidated affiliate. As a result,

in the fourth quarter of 2007, we reversed approximately $82 million of valuation allowances associated with foreign tax

credit carryovers that are more likely than not to be claimed on future tax returns. In 2007, benefits associated with our

foreign and U.S. tax effects attributable to foreign operations were negatively impacted by $36 million of expense

associated with the $275 million intercompany dividend and approximately $20 million of expense for adjustments to our

deferred tax balances as a result of the Mexico tax law change enacted during the fourth quarter of 2007.

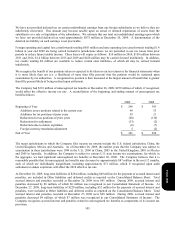

Adjustments to reserves and prior years include the effects of the reconciliation of income tax amounts recorded in our

Consolidated Statements of Income to amounts reflected on our tax returns, including any adjustments to the Consolidated

Balance Sheets. Adjustments to reserves and prior years also includes changes in tax reserves, including interest thereon,

established for potential exposure we may incur if a taxing authority takes a position on a matter contrary to our position.

We evaluate these reserves on a quarterly basis to ensure that they have been appropriately adjusted for events, including

audit settlements that we believe may impact our exposure.

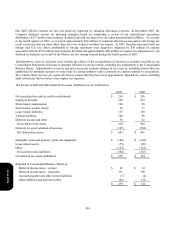

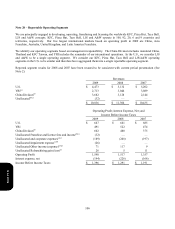

The details of 2009 and 2008 deferred tax assets (liabilities) are set forth below:

2009 2008

N

et operating loss and tax credit carryforwards

$

230 $ 256

Employee benefits 148 233

Share-based compensation 106 96

Self-insured casualty claims 59 71

Lease related liabilities 157 150

Various liabilities 100 98

Deferred income and other 30 41

Gross deferred tax assets 830 945

Deferred tax asset valuation allowances (187

)

(254)

Net deferred tax assets

$

643 $ 691

Intangible assets and property, plant and equipment

$

(184

)

$ (164)

Lease related assets (75

)

(69)

Other (125

)

(134)

Gross deferred tax liabilities (384

)

(367)

N

et deferred tax assets (liabilities)

$

259 $ 324

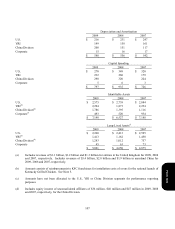

Reported in Consolidated Balance Sheets as:

Deferred income taxes – current

$

81 $ 81

Deferred income taxes – long-term 251 300

Accounts payable and other current liabilities (7 ) (4

)

Other liabilities and deferred credits (66

)

(53 )

$

259 $ 324

Form 10-K