Pizza Hut 2009 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

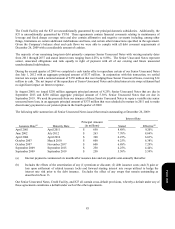

Acquisition of Interest in Little Sheep

During 2009, our China Division paid approximately $103 million, in several tranches, to purchase 27% of the

outstanding common shares of Little Sheep Group Limited (“Little Sheep”) and obtain Board of Directors representation.

We began reporting our investment in Little Sheep using the equity method of accounting and this investment is included

in Investments in unconsolidated affiliates on our Consolidated Balance Sheet. The fair value of our investment in Little

Sheep was approximately $156 million as of December 26, 2009. Equity income recognized from our investment in Little

Sheep was not significant in the year ended December 26, 2009.

Little Sheep is the leading brand in China’s “Hot Pot” restaurant category with approximately 375 restaurants, primarily

in China as well as Hong Kong, Japan, Canada and the U.S.

Consolidation of a Former Unconsolidated Affiliate in Shanghai, China

On May 4, 2009 we acquired an additional 7% ownership in the entity that operates more than 200 KFCs in Shanghai,

China for $12 million, increasing our ownership to 58%. The acquisition was driven by our desire to increase our

management control over the entity and further integrate the business with the remainder of our KFC operations in China.

This entity has historically been accounted for as an unconsolidated affiliate under the equity method of accounting due to

the effective participation of our partners in the significant decisions of the entity that were made in the ordinary course of

business. Concurrent with the acquisition we received additional rights in the governance of the entity, and thus we began

consolidating the entity upon acquisition. As required by GAAP, we remeasured our previously held 51% ownership in

the entity, which had a recorded value of $17 million at the date of acquisition, at fair value and recognized a gain of $68

million accordingly. This gain, which resulted in no related income tax expense, was recorded in Other (income) expense

on our Consolidated Statements of Income during the quarter ended June 13, 2009 and was not allocated to any segment

for performance reporting purposes.

We recorded the following identifiable assets acquired and liabilities assumed upon acquisition for the consolidated entity:

Current assets, including cash of $17 $ 27

Property, plant and equipment 61

Goodwill 53

Intangible assets 114

Other long-term assets 2

Total assets acquired 257

Current liabilities 55

Other long-term liabilities 35

Total liabilities assumed 90

Net assets acquired $ 167

Additionally, $70 million was recorded as Noncontrolling interest in our Consolidated Balance Sheet, representing the fair

value of our partner’s interest in the entity’s net assets upon acquisition. Intangible assets primarily comprise reacquired

franchise rights which are being amortized over the franchise contract period of ten years. Goodwill is not expected to be

deductible for income tax purposes.

Form 10-K