Pizza Hut 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Liquidity and Capital Resources

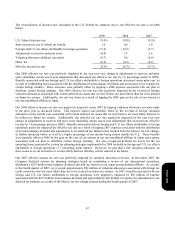

Operating in the QSR industry allows us to generate substantial cash flows from the operations of our company stores and

from our substantial franchise operations which require a limited YUM investment. In each of the last eight fiscal years,

net cash provided by operating activities has exceeded $1.1 billion. We expect these levels of net cash provided by

operating activities to continue in the foreseeable future. However, unforeseen downturns in our business could adversely

impact our cash flows from operations from the levels historically realized.

In the event our cash flows are negatively impacted by business downturns, we believe we have the ability to temporarily

reduce our discretionary spending without significant impact to our long-term business prospects. Our discretionary

spending includes capital spending for new restaurants, acquisitions of restaurants from franchisees, repurchases of shares

of our Common Stock and dividends paid to our shareholders. Additionally, as of December, 2009 we had approximately

$1.3 billion in unused capacity under our revolving credit facilities that expire in 2012, primarily related to a domestic

facility.

Our China Division and YRI represent more than 60% of the Company’s operating profit and both generate a significant

amount of positive cash flows that we have historically used to fund our international development. To the extent we

have needed to repatriate international cash to fund our U.S. discretionary cash spending, including share repurchases,

dividends and debt repayments, we have historically been able to do so in a tax efficient manner. As a result of our

substantial international development a significant amount of non-cash undistributed earnings in our foreign subsidiaries

is considered indefinitely reinvested as of December 26, 2009. If we experience an unforeseen decrease in our cash flows

from our U.S. business or are unable to refinance future U.S. debt maturities we may be required to repatriate future

international earnings at tax rates higher than we have historically experienced.

We are currently managing our cash and debt positions in order to maintain our current investment grade ratings from

Standard & Poor’s Rating Services (BBB-) and Moody’s Investors Service (Baa3). As a commitment to maintaining our

investment grade rating we improved our capital structure by extending our scheduled debt maturities while reducing our

debt outstanding during 2009. Additionally, we funded $280 million of our unfunded pension obligation and did not

repurchase shares of our Common Stock. Subsequent to year end, we have resumed repurchasing shares of our Common

Stock. However we believe we can do so while maintaining a capital structure that allows us to remain an investment

grade borrower. While we do not anticipate a downgrade in our credit rating, a downgrade would increase the Company’s

current borrowing costs and could impact the Company’s ability to access the credit markets if necessary. Based on the

amount and composition of our debt at December 26, 2009, which included a minimal amount outstanding under our

credit facilities, our interest expense would not materially increase on a full year basis should we receive a one-level

downgrade in our ratings.

Discretionary Spending

During 2009, we invested $797 million in our businesses, including approximately $275 million in the U.S., $232 million

for the International Division and $290 million for the China Division. For 2010, we estimate capital spending will be

approximately $1 billion.

During the year ended December 26, 2009, we paid cash dividends of $362 million. Additionally, on November 20, 2009

our Board of Directors approved cash dividends of $0.21 per share of Common Stock to be distributed on February 5,

2010 to shareholders of record at the close of business on January 15, 2010. The Company is targeting an ongoing annual

dividend payout ratio of 35% - 40% of net income.

The Company did not repurchase shares of our Common Stock during 2009. As of December 26, 2009, we have $300

million (excluding applicable transaction fees) available for future repurchases under a share repurchase authorization that

expires in September 2010.

Form 10-K