Pizza Hut 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Cash and Cash Equivalents. Cash equivalents represent funds we have temporarily invested (with original maturities

not exceeding three months) as part of managing our day-to-day operating cash receipts and disbursements, including

short-term, highly liquid debt securities.

Inventories. We value our inventories at the lower of cost (computed on the first-in, first-out method) or market.

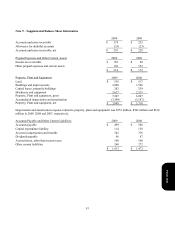

Property, Plant and Equipment. We state property, plant and equipment at cost less accumulated depreciation and

amortization. We calculate depreciation and amortization on a straight-line basis over the estimated useful lives of the

assets as follows: 5 to 25 years for buildings and improvements, 3 to 20 years for machinery and equipment and 3 to 7

years for capitalized software costs. As discussed above, we suspend depreciation and amortization on assets related to

restaurants that are held for sale.

Leases and Leasehold Improvements. The Company leases land, buildings or both for nearly 6,200 of its restaurants

worldwide. Lease terms, which vary by country and often include renewal options, are an important factor in determining

the appropriate accounting for leases including the initial classification of the lease as capital or operating and the timing

of recognition of rent expense over the duration of the lease. We include renewal option periods in determining the term

of our leases when failure to renew the lease would impose a penalty on the Company in such an amount that a renewal

appears to be reasonably assured at the inception of the lease. The primary penalty to which we are subject is the

economic detriment associated with the existence of leasehold improvements which might be impaired if we choose not to

continue the use of the leased property. Leasehold improvements, which are a component of buildings and improvements

described above, are amortized over the shorter of their estimated useful lives or the lease term. We generally do not

receive leasehold improvement incentives upon opening a store that is subject to a lease.

We expense rent associated with leased land or buildings while a restaurant is being constructed whether rent is paid or

we are subject to a rent holiday. Additionally, certain of the Company's operating leases contain predetermined fixed

escalations of the minimum rent during the lease term. For leases with fixed escalating payments and/or rent holidays, we

record rent expense on a straight-line basis over the lease term, including any option periods considered in the

determination of that lease term. Contingent rentals are generally based on sales levels in excess of stipulated amounts,

and thus are not considered minimum lease payments and are included in rent expense when achievement of the stipulated

amount is considered probable.

Internal Development Costs and Abandoned Site Costs. We capitalize direct costs associated with the site acquisition

and construction of a Company unit on that site, including direct internal payroll and payroll-related costs. Only those

site-specific costs incurred subsequent to the time that the site acquisition is considered probable are capitalized. If we

subsequently make a determination that a site for which internal development costs have been capitalized will not be

acquired or developed, any previously capitalized internal development costs are expensed and included in G&A

expenses.

Goodwill and Intangible Assets. From time to time, the Company acquires restaurants from one of our Concept’s

franchisees or acquires another business. Goodwill from these acquisitions represents the excess of the cost of a business

acquired over the net of the amounts assigned to assets acquired, including identifiable intangible assets and liabilities

assumed. The primary identifiable intangible asset we record in an acquisition of restaurants of one of our Concepts from

a franchisee is reacquired franchise rights. If a Company restaurant is sold within two years of acquisition, the goodwill

associated with the acquisition is written off in its entirety. If the restaurant is refranchised beyond two years, the amount

of goodwill written off is based on the relative fair value of the refranchised restaurant to the fair value of the reporting

unit, as described below.

Form 10-K