Pizza Hut 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21MAR201012032

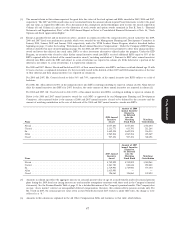

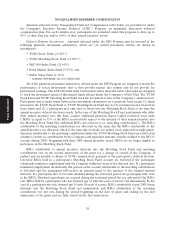

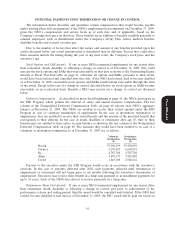

OPTION EXERCISES AND STOCK VESTED

The table below shows the number of shares of YUM common stock acquired during 2009 upon

exercise of stock options and vesting of stock awards in the form of RSUs, each before payment of

applicable withholding taxes and broker commissions.

Option Awards Stock Awards

Number of Shares Value Realized Number of Shares Value realized

Acquired on Exercise on Exercise Acquired on Vesting on Vesting

Name and Principal Position (#) ($) (#)(1) ($)

(a) (b) (c) (d) (e)

Novak 2,562,780 66,299,434 181,581 5,556,492

Carucci 95,308 2,522,927 16,174 463,508

Su 257,062 5,838,931 73,028 2,233,455

Allan 287,564 7,038,615 0 0

Creed 39,541 908,896 30,607 877,169

(1) These amounts represent RSUs that became vested in 2009. These shares will be distributed in

accordance with the deferral election made by the NEO under the EID Program. See page 58 for a

discussion of the EID Program.

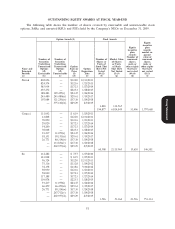

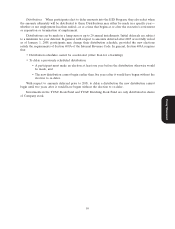

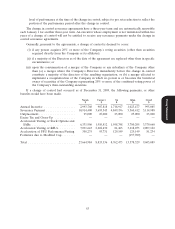

PENSION BENEFITS

The table below shows the present value of accumulated benefits payable to each of the NEOs,

including the number of years of service credited to each such NEO, under the YUM! Brands Retirement

Plan (‘‘Retirement Plan’’) and the YUM! Brands, Inc. Pension Equalization Plan (‘‘Pension Equalization

Plan’’) or the YUM! Brands International Retirement Plan determined using interest rate and mortality

rate assumptions consistent with those used in the Company’s financial statements.

2008 Fiscal Year Pension Benefits Table

Number of Present Value of Payments

Years of Accumulated During

Proxy Statement

Credited Service Benefit(4) Last Fiscal Year

Name Plan Name (#) ($) ($)

(a) (b) (c) (d) (e)

Novak Retirement Plan(1) 23 798,700 —

Pension Equalization Plan(2) 23 17,288,734 —

Carucci Retirement Plan 25 512,966 —

Pension Equalization Plan 25 3,234,740 —

Su International Retirement

Plan(3) 20 6,211,859 —

Allan Retirement Plan 6* 215,610 —

Pension Equalization Plan 6* 1,606,631 —

Creed Retirement Plan 2* 59,452 —

Pension Equalization Plan 2* 0 —

* Under these plans, Messrs. Allan and Creed only receive credited service for their eligible U.S.

based service. Mr. Allan was based outside the U.S. for 11 years. Mr. Creed was based outside the

U.S. for 7 years. During that time neither accrued a benefit under any retirement plan based upon

final compensation or years of service like these plans. In addition, under the terms of Mr. Creed’s

assignment in the U.S., he is covered under an Australian defined contribution plan related to his

service in Australia prior to his transfer to the U.S. to which the Company made annual

contributions in 2009. Contributions on Mr. Creed’s behalf to the Australian defined contribution

53