Pizza Hut 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

29

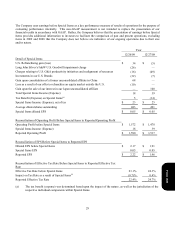

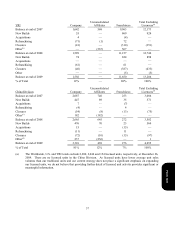

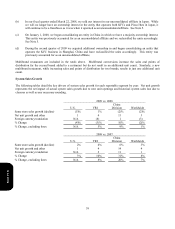

The Company uses earnings before Special Items as a key performance measure of results of operations for the purpose of

evaluating performance internally. This non-GAAP measurement is not intended to replace the presentation of our

financial results in accordance with GAAP. Rather, the Company believes that the presentation of earnings before Special

Items provides additional information to investors to facilitate the comparison of past and present operations, excluding

items in 2009 and 2008 that the Company does not believe are indicative of our ongoing operations due to their size

and/or nature.

Year

12/26/09 12/27/08

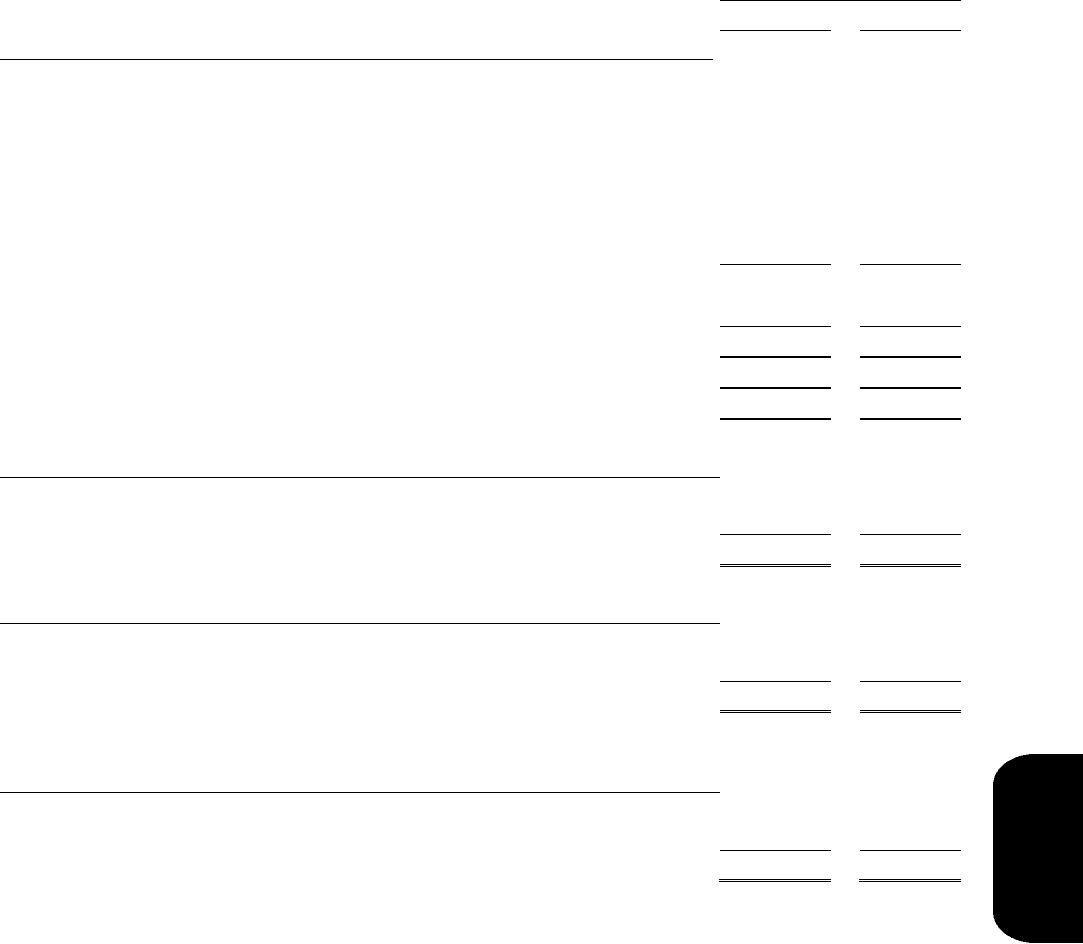

Detail of Special Items

U.S. Refranchising gain (loss) $ 34

$ (5)

Long John Silver’s/A&W U.S. Goodwill impairment charge (26) —

Charges relating to U.S. G&A productivity initiatives and realignment of resources (16) (49)

Investments in our U.S. Brands (32) (7)

Gain upon consolidation of a former unconsolidated affiliate in China 68 —

Loss as a result of our offer to refranchise an equity market outside the U.S. (10)

—

Gain upon the sale of our interest in our Japan unconsolidated affiliate — 100

Total Special Items Income (Expense) 18 39

Tax Benefit (Expense) on Special Items(a) 5 (14)

Special Items Income (Expense), net of tax $ 23 $ 25

Average diluted shares outstanding 483 491

Special Items diluted EPS $ 0.05 $ 0.05

Reconciliation of Operating Profit Before Special Items to Reported Operating Profit

Operating Profit before Special Items $ 1,572 $ 1,478

Special Items Income (Expense) 18 39

Reported Operating Profit $ 1,590 $ 1,517

Reconciliation of EPS Before Special Items to Reported EPS

Diluted EPS before Special Items $ 2.17 $ 1.91

Special Items EPS 0.05 0.05

Reported EPS $ 2.22 $ 1.96

Reconciliation of Effective Tax Rate Before Special Items to Reported Effective Tax

Rate

Effective Tax Rate before Special Items 23.1% 24.3%

Impact on Tax Rate as a result of Special Items(a) (0.7)% 0.4%

Reported Effective Tax Rate 22.4% 24.7%

(a) The tax benefit (expense) was determined based upon the impact of the nature, as well as the jurisdiction of the

respective individual components within Special Items.

Form 10-K