Pizza Hut 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23MAR200920294881

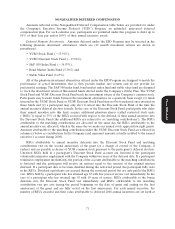

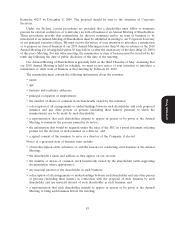

EQUITY COMPENSATION PLAN INFORMATION

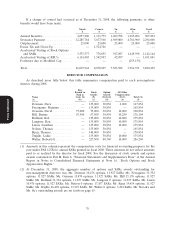

The following table summarizes, as of December 31, 2008, the equity compensation plans under which

we may issue shares of stock to our directors, officers and employees under the 1999 Long Term Incentive

Plan (‘‘1999 Plan’’), the 1997 Long Term Incentive Plan (the ‘‘1997 Plan’’), SharePower Plan and

Restaurant General Manager Stock Option Plan (‘‘RGM Plan’’).

Number of Securities

Number of Securities Remaining Available for

To be Issued Upon Future Issuance Under

Exercise of Weighted-Average Equity Compensation

Outstanding Exercise Price of Plans (Excluding

Options, Warrants Outstanding Options, Securities Reflected in

Plan Category and Rights Warrants and Rights Column (a))

(a) (b) (c)

Equity compensation plans approved by

security holders ................. 34,420,478(1) $ 20.35(2) 23,202,071(3)

Equity compensation plans not approved

by security holders(4) ............. 2,661,531 $ 22.50(2) 7,096,643

Total .......................... 37,082,009(1) $ 20.55(2) 30,298,714(3)

(1) Includes 6,487,980 shares issuable in respect of RSUs, performance units and deferred units.

(2) Weighted average exercise price of outstanding options and SARs only.

(3) Includes 11,809,582 shares available for issuance of awards of stock units, restricted stock, restricted

stock units and performance share unit awards under the 1999 Plan.

(4) Awards are made under the RGM Plan.

What are the key features of the 1999 Plan?

The 1999 Plan provides for the issuance of up to 70,600,000 shares of stock as non-qualified stock

options, incentive stock options, SARs, restricted stock, restricted stock units, performance shares or

Proxy Statement

performance units. Only our employees and directors are eligible to receive awards under the 1999 Plan.

The purpose of the 1999 Plan is to motivate participants to achieve long range goals, attract and retain

eligible employees, provide incentives competitive with other similar companies and align the interest of

employees and directors with those of our shareholders. The 1999 Plan is administered by the

Compensation Committee of the Board of Directors. The exercise price of a stock option grant or SAR

under the 1999 Plan may not be less than the average market price of our stock on the date of grant for

years prior to 2008 or the closing price of our stock on the date of the grant beginning in 2008, and no

options or SARs may have a term of more than ten years. The options and SARs that are currently

outstanding under the 1999 Plan generally vest over a one to four year period and expire ten years from the

date of the grant. The 1999 Plan was approved by the shareholders in May 1999, and they approved the

plan as amended in 2003 and again in 2008.

What are the key features of the 1997 Plan?

The 1997 Plan provides for the issuance of up to 45,000,000 shares of stock. Effective January 1, 2002,

only restricted shares could be issued under this plan. This plan is utilized with respect to payouts on shares

from our deferral plans and was originally approved by PepsiCo, Inc. as the sole shareholder of the

Company in 1997, prior to the spin-off of the Company from PepsiCo, Inc. on October 6, 1997.

What are the key features of the SharePower Plan?

The SharePower Plan provides for the issuance of up to 28,000,000 shares of stock. The SharePower

Plan allows us to award non-qualified stock options, stock appreciation rights (‘SARs‘), restricted stock and

78