Pizza Hut 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

23MAR200920294881

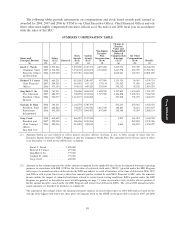

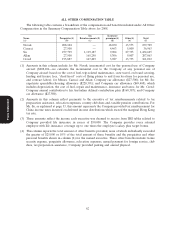

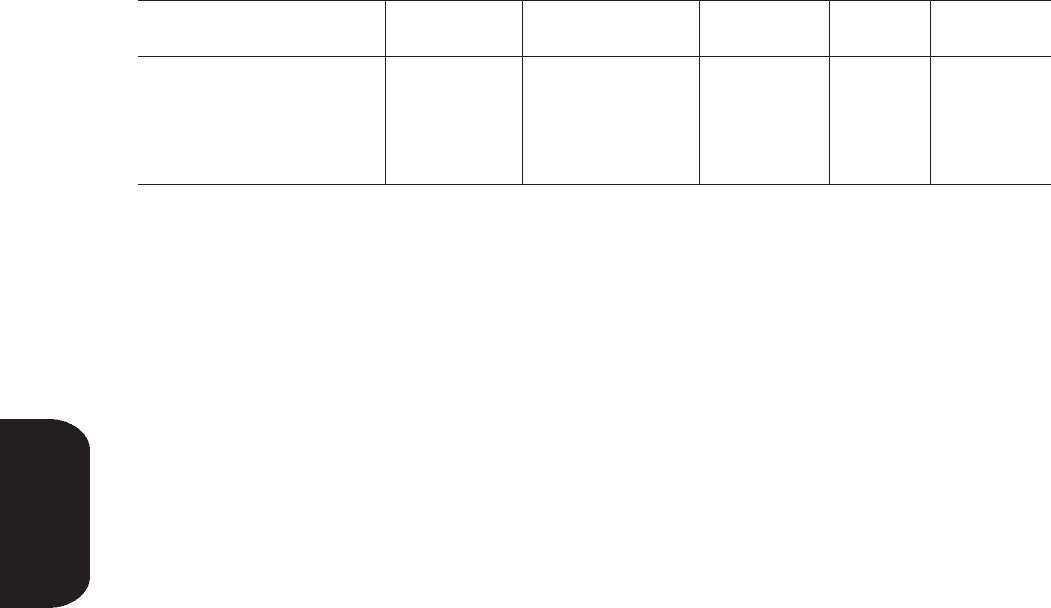

ALL OTHER COMPENSATION TABLE

The following table contains a breakdown of the compensation and benefits included under All Other

Compensation in the Summary Compensation Table above for 2008.

Tax Insurance

Name Perquisites(1) Reimbursements(2) premiums(3) Other(4) Total

(a) (b) (c) (d) (e) (f)

Novak 208,104 — 18,030 13,575 239,709

Carucci 27,500 — 4,463 5,000 36,963

Su 277,799 1,119,187 9,904 27,735 1,434,625

Allan 27,500 165,250 5,306 9,007 207,063

Creed 195,887 147,403 3,987 13,735 361,012

(1) Amounts in this column include for Mr. Novak: incremental cost for the personal use of Company

aircraft ($208,104—we calculate the incremental cost to the Company of any personal use of

Company aircraft based on the cost of fuel, trip-related maintenance, crew travel, on board catering,

landing and license fees, ‘‘dead head’’ costs of flying planes to and from locations for personal use,

and contract labor); for Messrs. Carucci and Allan: Company car allowance ($27,500); for Mr. Su:

expatriate spendables/housing allowance ($228,391); and Company car allowance ($49,408), which

includes depreciation, the cost of fuel, repair and maintenance, insurance and taxes; for Mr. Creed:

Company annual contribution to his Australian defined contribution plan ($168,387); and Company

car allowance ($27,500).

(2) Amounts in this column reflect payments to the executive of tax reimbursements related to tax

preparation assistance, relocation expenses, country club dues and, taxable pension contributions. For

Mr. Su, as explained at page 53, this amount represents the Company provided tax reimbursement for

China income taxes incurred on deferred income distributions which exceed the marginal Hong Kong

tax rate.

(3) These amounts reflect the income each executive was deemed to receive from IRS tables related to

Company provided life insurance in excess of $50,000. The Company provides every salaried

Proxy Statement

employee with life insurance coverage up to one times the employee’s salary plus target bonus.

(4) This column reports the total amount of other benefits provided, none of which individually exceeded

the greater of $25,000 or 10% of the total amount of these benefits and the perquisites and other

personal benefits shown in column (b) for the named executive. These other benefits include: home

security expense, perquisite allowance, relocation expenses, annual payment for foreign service, club

dues, tax preparation assistance, Company provided parking and annual physical.

62