Pizza Hut 2008 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Fair Value

At December 27, 2008 and December 29, 2007, the fair values of cash and cash equivalents, accounts receivable and

accounts payable approximated their carrying values because of the short-term nature of these instruments. The fair value

of notes receivable approximates the carrying value after consideration of recorded allowances. Accounts receivable

consists primarily of amounts due from franchisees and licensees for initial and continuing fees. In addition, we have

notes and lease receivables from certain of our franchisees. The financial condition of these franchisees and licensees is

largely dependent upon the underlying business trends of our Concepts. This concentration of credit risk is mitigated, in

part, by the large number of franchisees and licensees of each Concept and the short-term nature of the franchise and

license fee receivables.

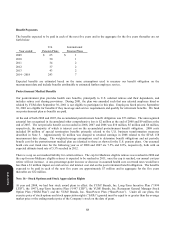

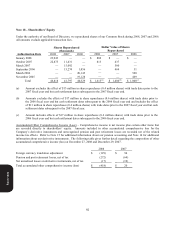

On December 30, 2007, the Company adopted the provisions of SFAS 157 related to its financial assets and

liabilities. The carrying amounts and fair values of our other financial instruments not measured on a recurring basis

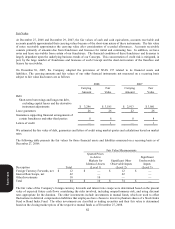

subject to fair value disclosures are as follows:

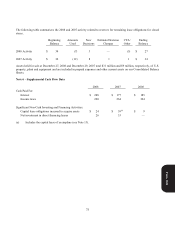

2008 2007

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Debt

Short-term borrowings and long-term debt,

excluding capital leases and the derivative

instrument adjustments $ 3,296 $ 3,185 $ 2,913 $ 3,081

Lease guarantees 26 26 22 26

Guarantees supporting financial arrangements of

certain franchisees and other third parties 8 8 8 8

Letters of credit

—

1

—

1

We estimated the fair value of debt, guarantees and letters of credit using market quotes and calculations based on market

rates.

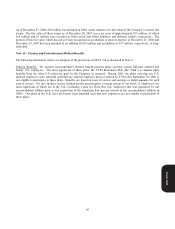

The following table presents the fair values for those financial assets and liabilities measured on a recurring basis as of

December 27, 2008:

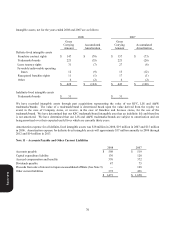

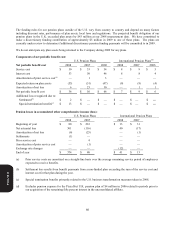

Fair Value Measurements

Description Total

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Foreign Currency Forwards, net $ 12 $

—

$ 12 $

—

Interest Rate Swaps, net 62

—

62

—

Other Investments 10 10

—

—

Total $ 84 $ 10 $ 74 $

—

The fair value of the Company’s foreign currency forwards and interest rate swaps were determined based on the present

value of expected future cash flows considering the risks involved, including nonperformance risk, and using discount

rates appropriate for the duration. The other investments include investments in mutual funds, which are used to offset

fluctuations in deferred compensation liabilities that employees have chosen to invest in phantom shares of a Stock Index

Fund or Bond Index Fund. The other investments are classified as trading securities and their fair value is determined

based on the closing market prices of the respective mutual funds as of December 27, 2008.

Form 10-K