Pizza Hut 2008 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

We monitor the financial condition of our franchisees and licensees and record provisions for estimated losses on

receivables when we believe that our franchisees or licensees are unable to make their required payments. While we use

the best information available in making our determination, the ultimate recovery of recorded receivables is also

dependent upon future economic events and other conditions that may be beyond our control. Net provisions for

uncollectible franchise and license receivables of $8 million, $2 million and $2 million were included in Franchise and

license expenses in 2008, 2007 and 2006, respectively.

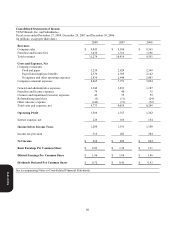

Revenue Recognition. Our revenues consist of sales by Company operated restaurants and fees from our franchisees and

licensees. Revenues from Company operated restaurants are recognized when payment is tendered at the time of sale.

The Company presents sales net of sales tax and other sales related taxes. We recognize initial fees received from a

franchisee or licensee as revenue when we have performed substantially all initial services required by the franchise or

license agreement, which is generally upon the opening of a store. We recognize continuing fees based upon a percentage

of franchisee and licensee sales as earned. We recognize renewal fees when a renewal agreement with a franchisee or

licensee becomes effective. We include initial fees collected upon the sale of a restaurant to a franchisee in Refranchising

(gain) loss.

Direct Marketing Costs. We charge direct marketing costs to expense ratably in relation to revenues over the year in

which incurred and, in the case of advertising production costs, in the year the advertisement is first shown. Deferred

direct marketing costs, which are classified as prepaid expenses, consist of media and related advertising production costs

which will generally be used for the first time in the next fiscal year and have historically not been significant. To the

extent we participate in advertising cooperatives, we expense our contributions as incurred. Our advertising expenses

were $584 million, $556 million and $521 million in 2008, 2007 and 2006, respectively. We report substantially all of

our direct marketing costs in occupancy and other operating expenses.

Research and Development Expenses. Research and development expenses, which we expense as incurred, are reported

in G&A expenses. Research and development expenses were $34 million, $39 million and $33 million in 2008, 2007 and

2006, respectively.

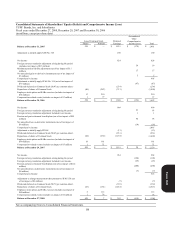

Share-Based Employee Compensation. We account for share-based employee compensation in accordance with SFAS

No. 123 (Revised 2004), “Share-Based Payment” (“SFAS 123R”). SFAS 123R requires all share-based payments to

employees, including grants of employee stock options and stock appreciation rights (“SARs”), to be recognized in the

financial statements as compensation cost over the service period based on their fair value on the date of grant.

Compensation cost is recognized over the service period on a straight-line basis for the fair value of awards that actually

vest.

Impairment or Disposal of Long-Lived Assets. In accordance with SFAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets” (“SFAS 144”), we review our long-lived assets related to each restaurant that we are

currently operating and have not offered to refranchise, including any allocated intangible assets subject to amortization,

semi-annually for impairment, or whenever events or changes in circumstances indicate that the carrying amount of a

restaurant may not be recoverable. We evaluate restaurants using a “two-year history of operating losses” as our primary

indicator of potential impairment. Based on the best information available, we write down an impaired restaurant to its

estimated fair market value, which becomes its new cost basis. Fair value is determined by discounting the forecasted

after tax cash flows, including terminal value, of the restaurant. The discount rate is our estimate of the required rate of

return that a third-party buyer would expect to receive when purchasing a restaurant or groups of restaurants and its

related long-lived assets. The discount rate incorporates observed rates of returns for historical refranchising market

transactions and we believe it is commensurate with the risks and uncertainty inherent in the forecasted cash flows. In

addition, when we decide to close a restaurant it is reviewed for impairment and depreciable lives are adjusted based on

the expected disposal date. The impairment evaluation is based on the estimated cash flows from continuing use through

the expected disposal date plus the expected terminal value.

Form 10-K