Pizza Hut 2008 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2008 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

79

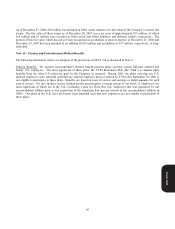

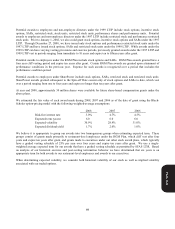

Interest expense on short-term borrowings and long-term debt was $253 million, $199 million and $172 million in 2008,

2007 and 2006, respectively.

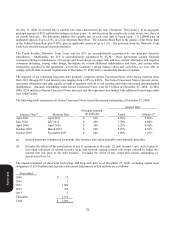

Note 13 – Leases

At December 27, 2008 we operated more than 7,300 restaurants, leasing the underlying land and/or building in more than

5,800 of those restaurants with the vast majority of our commitments expiring within 20 years from the inception of the

lease. Our longest lease expires in 2151. We also lease office space for headquarters and support functions, as well as

certain office and restaurant equipment. We do not consider any of these individual leases material to our operations.

Most leases require us to pay related executory costs, which include property taxes, maintenance and insurance.

In 2007, we entered into an agreement to lease a corporate aircraft to enhance our international travel capabilities. This

lease provided for an upfront payment of $10 million and monthly payments for three years. At the end of the three year

period we have the option to purchase the aircraft. In accordance with SFAS No. 13, this lease has been classified as

capital and we had a related capital lease obligation recorded of $40 million at December 27, 2008. Our lease is with

CVS Corporation (“CVS”). One of the Company’s directors is the Chairman, Chief Executive Officer and President of

CVS. Multiple independent appraisals were obtained during the negotiation process to insure that the lease was reflective

of an arms-length transaction.

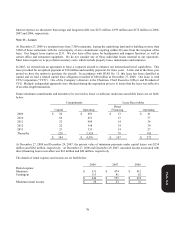

Future minimum commitments and amounts to be received as lessor or sublessor under non-cancelable leases are set forth

below:

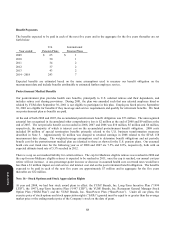

At December 27, 2008 and December 29, 2007, the present value of minimum payments under capital leases was $234

million and $282 million, respectively. At December 27, 2008 and December 29, 2007, unearned income associated with

direct financing lease receivables was $63 million and $46 million, respectively.

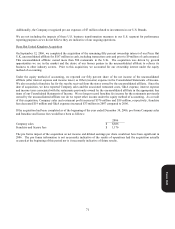

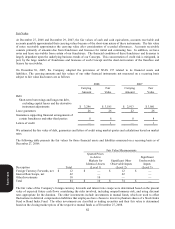

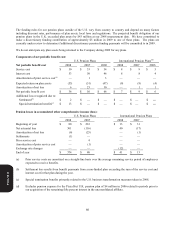

The details of rental expense and income are set forth below:

2008 2007 2006

Rental expense

Minimum $ 531 $ 47

4

$ 41

2

Contingent 113 81 6

2

$ 64

4

$ 555 $ 47

4

Minimum rental income $ 28 $ 23 $ 21

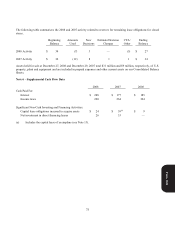

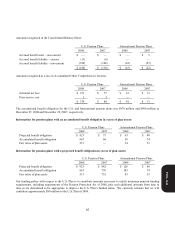

Commitments Lease Receivables

Capital

Operating

Direct

Financing

Operating

2009 $ 26 $ 491 $ 13 $ 41

2010 64 451 13 37

2011 23 409 14 34

2012 22 368 14 30

2013 21 333 14 27

Thereafter 228 2,524 79 103

$ 384 $ 4,576 $ 147 $ 272

Form 10-K